Let's be blunt: figuring out what you should be paying for car insurance can feel like trying to hit a moving target. The national average for full coverage currently sits at $2,638 per year, which breaks down to about $220 per month. But here’s the thing—that number is just a starting point.

Understanding the True Cost of Car Insurance

Think of the national average as a ballpark figure. It gives you a general idea of where the market is, but it doesn't tell you what your specific premium will be. The final price you pay is a unique mix of who you are, what you drive, where you live, and the broader economic trends affecting the entire insurance industry.

And right now, those trends are pushing costs up. We're seeing rates climb steadily across the board, thanks to factors like inflation, more expensive car repairs (blame all the new tech!), and an uptick in serious accidents. It’s a perfect storm that's hitting every driver's wallet.

A Snapshot of Rising Premiums

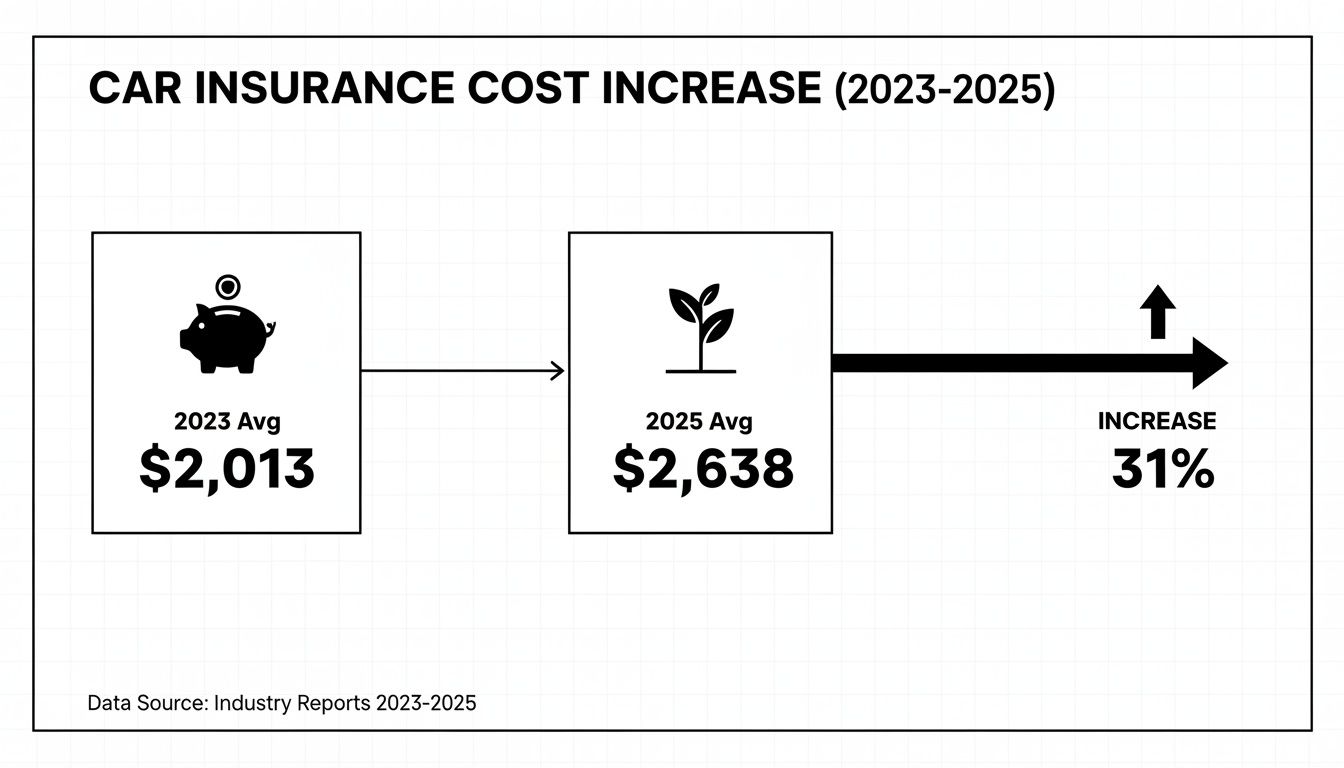

Just how much have things changed? In 2025, the national average for full coverage car insurance hit $2,638. That’s a steep 12% jump from 2024, meaning the typical driver is now paying an extra $289 a year.

But if we zoom out just a little bit, the picture gets even more dramatic. Go back to 2023, and the average was $2,013 per year. That's a whopping 31% increase in only two years.

Here's a quick look at how the numbers stack up:

Average Car Insurance Costs At a Glance

| Region | Average Annual Cost | Average Monthly Cost | Year-Over-Year Increase |

|---|---|---|---|

| National Average (2025) | $2,638 | $220 | 12% from 2024 |

| National Average (2024) | $2,349 (est.) | $196 (est.) | |

| National Average (2023) | $2,013 | $168 |

This steady climb shows why it's more important than ever to understand the forces driving your premium.

The chart below really drives home just how quickly rates have escalated.

This 31% spike isn't just a number—it’s a clear signal that external factors are directly impacting what you pay. Getting a handle on the average cost for car insurance gives you the knowledge to spot a fair deal and question a quote that seems way out of line.

Here's the good news: your rate isn't entirely out of your hands. While you can't control inflation, you absolutely have influence over the personal factors that insurers weigh most heavily. Your driving record, for example, is your single most powerful tool. A clean history, free from any recent moving violation, tells insurers you're a safe bet—and that almost always translates into a much better premium.

The 7 Key Factors That Drive Your Insurance Rate

Ever look at your car insurance bill and wonder why it’s so different from your friend’s or neighbor’s? You're not alone. Insurance companies aren't just picking numbers at random; they're performing a detailed risk assessment. At its core, they're trying to predict how likely you are to file a claim.

Think of it as building a complex profile of you as a driver. Every piece of information helps them paint a picture of your potential risk. The more risk factors they see, the higher your premium will be.

Let's pull back the curtain and look at the seven biggest factors that shape your insurance quote. Once you understand what they're looking for, you can start to take control of your costs.

1. Your Driving Record

This is the big one. More than anything else, your driving record tells an insurer what kind of driver you are. It’s a direct reflection of your habits behind the wheel—a clean record shows you’re a safe, low-risk bet.

On the flip side, a history of tickets, at-fault accidents, or a DUI is a huge red flag. A single speeding ticket can hike your rates by 20-30%, and a DUI can easily cause them to double or even triple. Insurers typically look at your history from the last 3 to 5 years.

A DUI conviction is a game-changer for insurers. Expect your rates to jump by 50% to 100%, if your policy isn't cancelled outright. It can force you into expensive "high-risk" plans, and the financial fallout can stick with you for years.

The best strategy is simple: keep your record clean. Every year you drive without an incident, you prove you're a responsible driver, which almost always leads to better rates.

2. Your Geographic Location

Where you live and park your car has a surprisingly big impact on your bill. Insurers use your ZIP code to analyze local risks that could lead to a claim.

They're looking at things like:

- Traffic and Congestion: Living in a dense city with lots of cars on the road means a higher statistical chance of an accident.

- Crime Rates: If your neighborhood has a high rate of car thefts or vandalism, the comprehensive portion of your premium will be higher.

- Weather Patterns: Areas prone to hurricanes, hail, or flooding mean a greater risk of weather-related damage claims.

- Lawsuit Frequency: In some regions, people are more likely to sue after an accident, which drives up the potential cost of claims for insurers.

Sometimes, moving just a few miles from a busy urban core to a quiet suburb can result in a noticeable drop in your premium.

3. Your Age and Driving Experience

The data doesn't lie: age and years behind the wheel directly correlate with accident rates. Young, inexperienced drivers—especially teens—are statistically far more likely to get into a crash. This is why they face some of the highest insurance premiums you'll see.

Rates usually start coming down around age 25, assuming the driver has kept a clean record. They tend to level out and stay low through your middle-aged years, which is when most people are considered to be at their safest.

But the trend can reverse for senior drivers, often around age 70 or 75. Insurers may begin to increase rates again to account for age-related changes in vision, hearing, and reaction times that can increase accident risk.

4. The Vehicle You Drive

The car you choose is another massive piece of the pricing puzzle. Insurers look closely at a vehicle's specific make, model, age, and safety history to figure out how much a potential claim might cost them.

Here's a quick breakdown of what they consider:

- Repair Costs: A new luxury SUV loaded with sensors and custom parts is going to cost a lot more to fix than a basic, 10-year-old sedan.

- Safety Ratings: Cars that perform well in crash tests and come with features like automatic emergency braking can earn you a discount.

- Theft Risk: Some models are just more popular with thieves. If you own a commonly stolen car, your comprehensive coverage will cost more.

- Performance: A sports car with a powerful engine is seen as a higher risk for speeding and accidents than a family minivan.

5. Your Chosen Coverage Types and Limits

Your insurance policy isn't a one-size-fits-all deal. The types of coverage you choose—and how much of it you buy—directly impact your premium. Going with the bare-minimum liability coverage required by your state will always be the cheapest route, but it leaves you with very little financial protection if something serious happens.

Adding these common coverages will increase your cost but also your peace of mind:

- Collision Coverage: Pays to repair your own car if you cause an accident.

- Comprehensive Coverage: Covers you for things other than a collision, like theft, vandalism, fire, or hitting a deer.

- Uninsured/Underinsured Motorist: Protects you if you're hit by someone who has little or no insurance.

- Higher Liability Limits: This is crucial. Buying more than the state minimum protects your savings and assets if you're found at fault in a major accident.

An easy way to lower your premium is by choosing a higher deductible (the amount you pay out-of-pocket on a claim). Just make sure it’s an amount you could comfortably come up with on short notice.

6. Your Credit-Based Insurance Score

In most states, insurance companies are allowed to use a credit-based insurance score when calculating your rate. This isn't the same as your FICO score, but it's built from similar information found in your credit report.

Why? Because industry data shows a strong correlation between how people manage their finances and their likelihood of filing an insurance claim. A better score suggests financial responsibility, which often translates directly into a lower premium.

7. Your Eligibility for Discounts

Finally, don't forget about discounts! This is one of the easiest ways to actively lower your bill. Insurers offer a ton of them, but they often don't apply them automatically—you have to ask.

Some of the most common discounts include:

- Multi-Policy: Bundling your auto insurance with your homeowners or renters policy.

- Multi-Car: Insuring more than one vehicle with the same company.

- Good Student: For young drivers who maintain a "B" average or higher.

- Defensive Driving Course: Completing an approved course can knock a few percentage points off your rate and teach you how to manage your points on insurance.

- Safety Features: Having anti-theft devices, airbags, or anti-lock brakes in your car.

- Low Mileage: For drivers who don't put a lot of miles on their car each year.

Real-World Examples of Car Insurance Costs

It’s one thing to talk about individual rating factors, but seeing how they all mix together is what really makes it all click. Think of your insurance premium as a story—one written by your unique circumstances.

Let's walk through three different driver profiles to show you just how much rates can swing based on a few key details. By understanding the "why" behind each number, you'll get a much better sense of where you might land on the cost spectrum.

Profile 1: The Young Professional

First up is Alex, a 22-year-old who just landed his first job out of college and is living in a bustling city neighborhood. To celebrate, he bought a sporty two-door coupe—a fun car, but one that insurers see as higher-risk due to its performance and, in his area, higher theft rates.

Simply put, young drivers face the steepest premiums. Statistics don't lie: drivers in their teens and early twenties are involved in more accidents. A 16-year-old will pay a fortune compared to a 40-year-old with a clean record, though things usually start getting cheaper after age 25. For a deeper dive, check out this great breakdown of how age impacts car insurance rates on Forbes Advisor.

From an insurer’s perspective, Alex’s profile is flashing a few warning lights:

- Age: Being under 25 automatically places him in the highest-risk group.

- Vehicle: A performance coupe costs more to repair and is a bigger target for theft.

- Location: Living in a dense urban ZIP code means more traffic and higher crime.

Estimated Monthly Premium: $350 – $450 for full coverage.

That high price tag is a direct result of his age, car choice, and city address. Each factor layers on more risk, and the premium reflects that.

Profile 2: The Suburban Family

Now, let's head to the suburbs and meet the Miller family. They're in their late 40s, have two cars (a reliable minivan and a standard sedan), and boast driving records that are completely spotless. Not a single accident or ticket for over a decade.

They’re also smart about their discounts. By bundling their auto and home insurance policies and keeping both cars with the same provider, they’re saving a nice chunk of change. Their profile is the definition of low risk.

To an insurance company, the Miller family represents stability and predictability. Their long history of safe driving, mature age, and practical vehicle choices make them the ideal customer.

Here’s why their rate is so much lower:

- Driving History: Flawless records for everyone in the household.

- Discounts: They’re maximizing savings with multi-policy and multi-car bundles.

- Vehicles: A minivan and a sedan are seen as safe, family-oriented cars.

Estimated Monthly Premium: $160 – $220 for full coverage on both vehicles.

This just goes to show you the incredible power of a clean record and smart discount shopping. It can literally cut your bill in half.

Profile 3: The City Commuter

Finally, we have Maria. She’s 35 and drives her 10-year-old sedan to work in the city every day. Since the car is paid off, she’s chosen to carry only liability coverage to keep her monthly expenses down.

There’s a catch, though: her record isn’t perfect. She had a minor at-fault fender-bender about two years ago. While it wasn't a huge accident, it’s still a red flag for insurers. Even a small at-fault incident can bump up your premium by 20% or more for several years.

Let’s break down her situation:

- Driving Record: One recent at-fault accident is keeping her rates up.

- Coverage Level: Opting for state-minimum liability offers the lowest price.

- Vehicle: An older, less valuable car means the insurer's potential payout is much lower.

Estimated Monthly Premium: $90 – $130 for liability-only coverage.

Maria’s premium is the lowest of the three, but that’s mostly because she has far less coverage. That fender-bender is preventing her from getting an even better rate, showing how just one mistake can linger on your record for years.

Real-World Ways to Lower Your Car Insurance Bill

Understanding what goes into your insurance premium is one thing, but actually putting that knowledge to work to save money is the real goal. The good news? You have far more control over that final number than you might think.

Think of your insurance policy less like a fixed, unchangeable bill and more like a flexible agreement. Your choices and habits directly impact the price you pay. With a few smart moves, you can trim your costs without giving up the protection you need.

H3: Don't Get Complacent: Shop Around

This is the big one. So many people stick with the same insurance company for years out of sheer habit, but loyalty rarely pays off in this industry. The insurer that gave you the best deal two years ago might not be the most competitive for you today.

Make it an annual ritual to shop for new quotes, especially right before your policy is set to renew. You might be shocked to find that rates for the exact same coverage can vary by hundreds of dollars from one company to the next. This single step is often the quickest path to immediate savings.

H3: Adjust Your Coverage and Deductibles

Your deductible is one of the most powerful levers you can pull to adjust your premium. This is simply the amount of money you agree to pay out of your own pocket on a claim before the insurance company steps in.

Think about this: just by raising your deductible from $500 to $1,000, you could see your premium drop by 15% to 30%. It’s a straightforward trade-off. You're telling the insurer you're willing to take on a bit more of the initial risk, and they reward you for it with a lower rate.

The key is to choose a deductible you could comfortably pay tomorrow without it causing a financial crisis. Don't set it so high that you'd be afraid to file a claim.

H3: Hunt Down Every Last Discount

Insurance companies have a ton of discounts available, but they don't always volunteer them—you often have to ask. Don't just assume your agent has automatically applied every discount you're eligible for. It's on you to be proactive.

When you do your annual policy review, make your agent walk through a full discount checklist with you. You might be leaving money on the table.

- Bundle Policies: This is low-hanging fruit. Combining your car insurance with your home or renters policy is almost always a guaranteed way to save.

- Safety Features: Make sure your insurer knows about your car's anti-theft system, anti-lock brakes, and airbags. Every feature helps.

- Good Student Discount: If you have a teen driver on your policy who keeps a B average or better, this can slash your rates significantly.

We've put together a more detailed list of tactics, so be sure to explore these other proven ways to lower your car insurance in our complete guide.

H3: Clean Up Your Driving Record

Your driving history is the bedrock of your insurance rate. While you can't erase a past mistake overnight, you can absolutely take steps to prove you're a safe, responsible driver. It’s a long-term play that always pays off.

One of the most direct ways to do this is by taking a state-approved defensive driving course. It shows your insurer you’re serious about safety, which can often lead directly to a discount.

Even better, completing a course like this can sometimes help you get points removed from your license after a ticket, which is huge for preventing future rate hikes. Insurers like GEICO explain the benefits of these courses and how they can positively affect your premium.

H3: Get Your Financial House in Order

It may seem unrelated, but in most states, your credit history has a real impact on your insurance premium. Insurers have data showing a strong link between how people manage their finances and how they drive.

This means that working to improve your overall financial health can also lead to cheaper car insurance. Simple habits like paying bills on time, keeping credit card balances low, and checking your credit report for errors will gradually improve your score and, ultimately, help lower your rate.

Actionable Steps to Reduce Your Premium

Feeling overwhelmed? Don't be. Here’s a quick-glance table breaking down the most effective strategies you can use to start saving money on your car insurance today.

| Strategy | Potential Savings | Effort Level |

|---|---|---|

| Shop Around Annually | High (10-40%) | Low |

| Increase Deductibles | Medium (15-30%) | Low |

| Bundle Policies | Medium (5-25%) | Low |

| Take a Defensive Driving Course | Low (5-10%) | Medium |

| Improve Your Credit Score | Medium (Varies) | High (Long-term) |

| Ask for All Discounts | Low (Varies) | Low |

Focus on the low-effort, high-impact strategies first—like shopping around and bundling—to see immediate results. Then, work on the longer-term goals for sustained savings.

How to Get Accurate Car Insurance Quotes

Getting a car insurance quote is easy. Getting an accurate one? That takes a little bit of prep work. Think of it like this: you can give a tailor a rough guess of your size, or you can give them your exact measurements. One gets you a decent fit, the other gets you a perfect one. The more precise you are with your information, the more reliable your quote will be.

If you’re vague, you'll get a vague price—one that can jump up significantly once the insurer runs your official reports. To skip the sticker shock, it’s best to have all your details lined up before you even start looking. This way, the price you see is the price you actually pay.

Gather Your Essential Information

To get a quote that sticks, you’ll need some specific details ready to go. This includes the Vehicle Identification Number (VIN) for every car you want to insure, the address where they’re kept overnight, and the driver's license numbers for everyone in your household who will be driving.

You'll also need to be upfront about your driving history—any recent tickets or at-fault accidents will come up eventually, so it's better to disclose them now. Having all this info on hand makes the whole process smoother and helps insurers calculate a real price based on facts, not guesswork. You can usually find the VIN on your current insurance card or on a small plate on the driver's side of the dashboard. Unsure about past tickets? Our guide on how to see my driving record can show you exactly what insurers see.

Choose Your Shopping Method

Once you have your info packet ready, you’ve got a few different ways to start shopping for quotes. Each has its own pros and cons, so pick the one that feels right for you.

Direct from the Insurer: Going straight to an insurance company’s website is quick and easy. This is a solid choice if you already have a preferred provider in mind or want to see what a specific company can offer.

Captive Agent: These agents represent a single company, like State Farm or Allstate. They know their company's policies inside and out and are experts at finding every last discount that applies to you.

Independent Agent or Broker: Think of these pros as your personal insurance shoppers. They work with multiple carriers, which means they can compare different options for you to find the best blend of price and coverage from across the market.

Make an Apples-to-Apples Comparison

This is where the rubber meets the road. A super-low quote means nothing if it leaves you dangerously underinsured. To make a truly informed decision, you absolutely must compare quotes with the exact same coverage limits, types, and deductibles.

Pro-Tip: Create a simple checklist before you start. Decide on your ideal liability limits (e.g., 100/300/100), whether you want collision and comprehensive, and what deductible you're comfortable paying. Apply that same checklist to every single quote you request.

This disciplined approach stops you from getting tempted by a lowball price that’s attached to a risky, bare-bones policy. To find the best rates, you have to compare providers and understand how their policies differ. Spending some time to discover auto insurance companies and what they offer will pay off, ensuring you're comparing policies that truly give you the same level of protection.

Common Questions About Car Insurance Costs

Even when you have a good handle on the big factors that drive your insurance premium, a few specific questions always seem to come up. Let's tackle some of those lingering uncertainties and clear up a few myths about car insurance pricing.

Think of this as your quick-reference guide to the questions we hear drivers ask most often. Getting these details straight will help you navigate your policy with more confidence.

Why Did My Insurance Rate Go Up with a Clean Record?

This is one of the most frustrating things that can happen to a safe driver. You haven't had a single ticket or accident, but your renewal notice comes in the mail with a higher price tag. What gives?

It happens because your personal driving habits are just one piece of a much larger puzzle. Your rate can climb due to factors that have absolutely nothing to do with you.

Here are a few common culprits:

- State-Wide Rate Adjustments: If an insurance company pays out more in claims across your state—maybe due to a bad hurricane season or more accidents overall—they often ask state regulators for permission to raise rates for everyone to cover their losses.

- Inflation and Repair Costs: Modern cars are packed with sensors, cameras, and computers. While this tech is great, it makes even minor fender-benders incredibly expensive to fix. As the cost of parts and labor goes up for insurers, those costs get passed along to customers.

- Changes in Your Neighborhood: Has your ZIP code seen a recent spike in car thefts or accidents? Insurers are always analyzing local data, and if your area is suddenly seen as higher-risk, your premium can creep up to match.

How Often Should I Shop for New Car Insurance?

The simple answer? At least once a year.

A more detailed answer is that you should also shop around anytime a major life event happens. Staying with the same company for years out of loyalty can be a costly mistake. The insurer that gave you the best deal last year might not be the most competitive one for you today.

A good rule of thumb is to start looking for new quotes about 30 to 45 days before your current policy renews. This gives you plenty of time to compare legitimate, apples-to-apples offers without feeling rushed.

It's also a smart move to get fresh quotes whenever you:

- Move to a new house or apartment.

- Buy a different car.

- Add or remove a driver from your policy (especially a teenager).

- Get married or divorced.

- See a big improvement in your credit score.

Any of these changes can completely reshape how an insurer sees your risk, potentially unlocking big savings if you switch to a different company.

Do Parking Tickets Affect My Insurance Rates?

For the most part, no. Standard parking tickets are considered non-moving violations, which is good news for your wallet. They don’t add points to your license and aren’t reported to your insurance company. Insurers care about violations that suggest risky driving, like speeding, not overstaying your welcome at a parking meter.

But there’s a big "if" here. If you let those parking tickets pile up unpaid, you can get into real trouble. Eventually, the state can suspend your driver's license for unpaid fines. A suspended license is a massive red flag for insurers and will cause your rates to skyrocket—or they might just drop you altogether.

So, while the ticket itself won't hurt you, ignoring it definitely will.

At BDISchool, we believe that understanding the rules of the road is the first step toward becoming a safer, more confident driver. Whether you need to handle a ticket with our Basic Driver Improvement course or want to snag an insurance discount with our Mature Driver program, our state-approved online courses are built for your busy schedule. Enroll today and take control of your driving record—and your insurance rates