Insurance companies reward safe drivers, and one of the fastest ways to prove you’re responsible behind the wheel is completing a driver safety course for insurance discount purposes. We at DriverEducators.com know that discounts can range from 5% to 15% depending on your insurer, and some policies offer even more.

The good news is that getting these savings doesn’t require years of perfect driving. A single approved course can qualify you for immediate premium reductions that add up to hundreds of dollars annually.

How Much Will Your Insurance Discount Actually Be

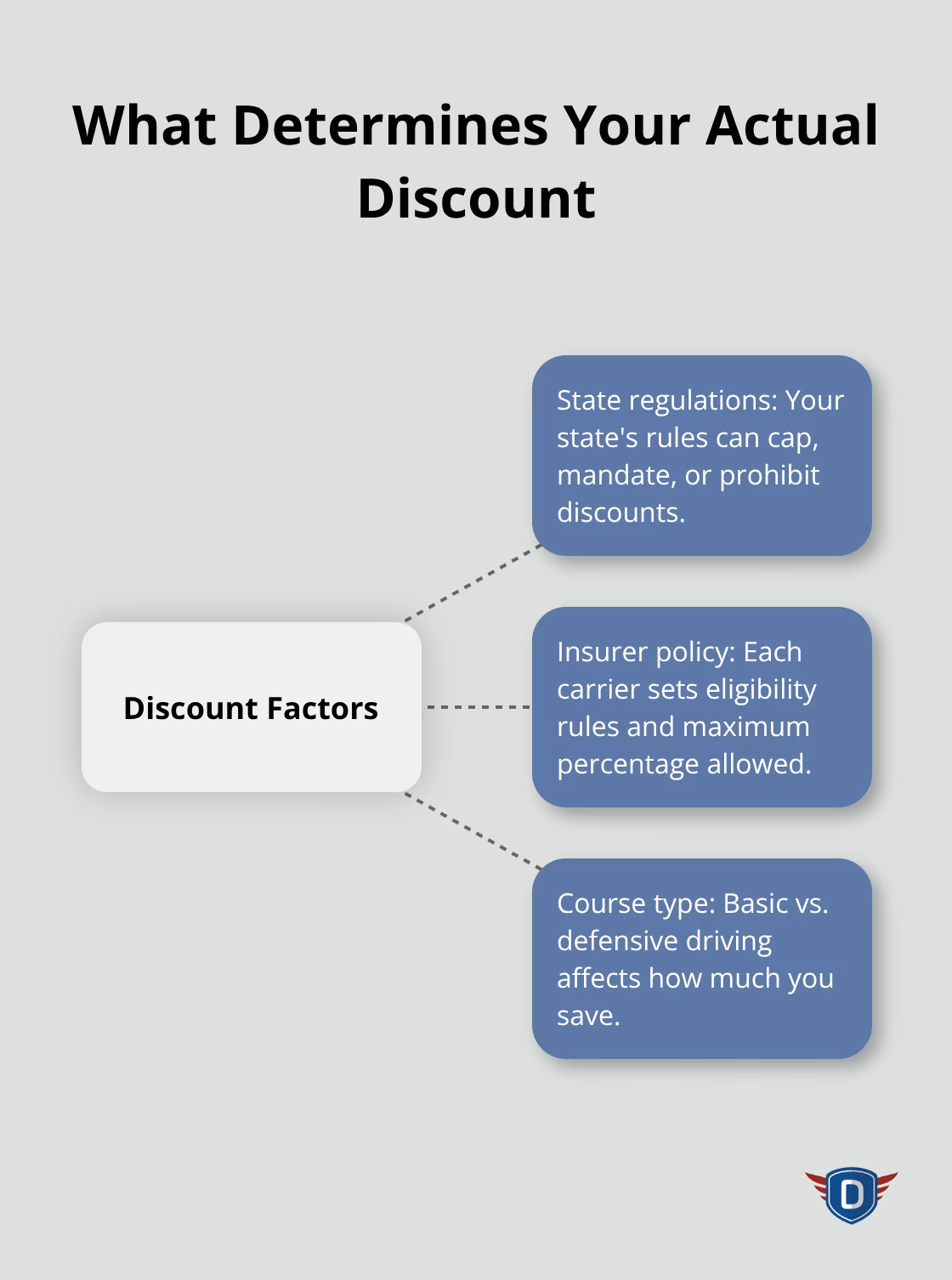

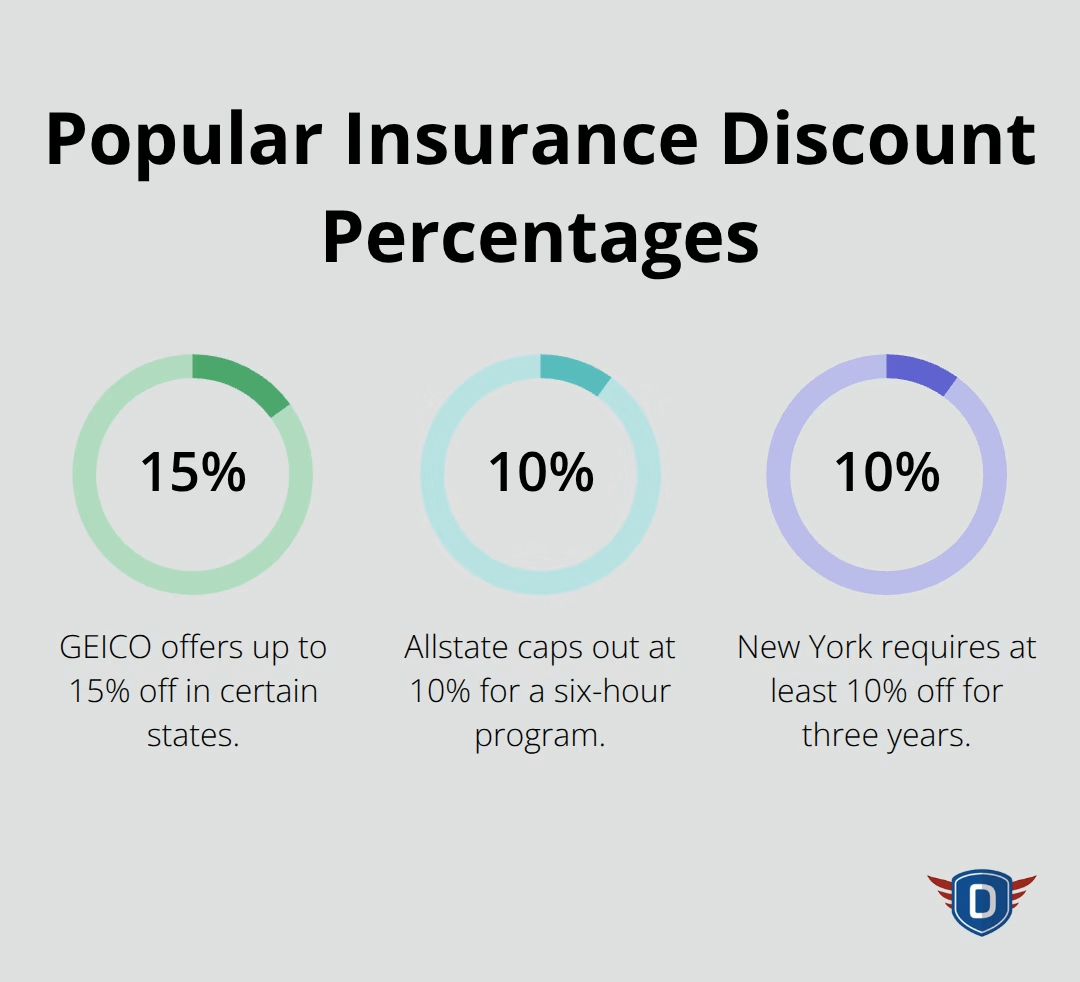

Insurance companies don’t apply discounts uniformly, and this is where many drivers face disappointment. GEICO offers up to 15% off in certain states, while Allstate caps out at 10% for completing a six-hour program. State Farm and Progressive use their own formulas entirely. Your actual discount depends on three factors: your state’s regulations, your insurer’s specific policy, and the type of course you complete.

State-by-State Discount Variations

New York requires insurers to offer at least 10% off for three years after completion, making it one of the most generous states. Meanwhile, Hawaii, Massachusetts, Michigan, Vermont, and North Carolina don’t offer defensive driving discounts at all, regardless of which course you take. This means your first step should involve contacting your insurer directly to learn the exact percentage available to you, not assuming it matches what your neighbor received.

How Long Your Discount Lasts

Most discounts last three to five years before you need to retake a course to maintain the savings. GEICO typically honors the discount for three years, after which your premium reverts to the standard rate unless you complete another approved course. Some insurers reset the clock automatically at renewal, while others require you to proactively enroll in a refresher.

A single course completion can save you between $50 and $200 annually depending on your base premium and the discount percentage. Over a three-year period, that compounds to $150 to $600 in total savings, which far exceeds the $25 to $100 cost of most online courses.

What Happens If Your Driving Record Changes

If you accumulate a moving violation or at-fault accident during the discount period, insurers typically remove the savings immediately at renewal. Completing a defensive driving course reduces accident rates in the following year, which is exactly why insurers protect these discounts so carefully. Your driving record must remain clean to keep the savings intact, making accident avoidance just as important as the course itself.

Understanding these discount mechanics helps you make informed decisions about which course to take and when. The next step involves selecting an approved provider that aligns with your state’s requirements and your insurer’s acceptance criteria.

Which Course Type Saves You the Most Money

Not all driver safety courses deliver equal insurance discounts, and the difference between course types can mean the gap between saving $100 annually versus $300. The National Safety Council reports a 17.6% reduction in state-recorded accidents in the year after completion, which explains why insurers reward these courses so generously. AARP Smart Driver courses completed by over 20 million drivers qualify participants for multi-year discounts with insurers like State Farm and GEICO, though exact savings depend on your carrier and state.

Basic Courses vs. Defensive Driving Programs

Basic driver improvement courses typically qualify you for the minimum discount your state allows, usually around 5% to 10%. Defensive driving programs that emphasize hazard anticipation and collision avoidance often unlock the full 10% to 15% range. A four-hour basic course covers traffic laws and violations, whereas an eight-hour defensive driving program teaches emergency maneuvers, adverse weather handling, and decision-making under pressure. This depth difference directly affects your discount percentage.

Specialized Courses for Specific Drivers

Specialized courses for high-risk drivers, including aggressive driver programs and mature driver refreshers, maintain eligibility for discounts even when your record is complicated. These typically cost between $50 and $100 versus $25 to $55 for standard online options. Mature driver courses, designed for drivers aged 55 and older, often qualify for additional age-based discounts stacked on top of the base course discount, potentially reaching 15% to 20% total savings.

Finding Approved Providers in Your State

Your insurer’s approved provider list determines which courses qualify in your state, so contact them before enrolling to prevent wasted time on ineligible options. The National Safety Council and American Safety Council online courses work across all 50 states, while state-specific programs like the New York Safety Program operate exclusively within their jurisdiction. AARP membership offers 10% off the Smart Driver course itself, creating immediate savings before your insurance discount even kicks in.

Matching Course Length to Insurer Requirements

Allstate requires a minimum six-hour program to qualify for their 10% discount, whereas GEICO accepts courses as short as four hours in most states. Matching course length to your insurer’s minimum prevents overpaying for unnecessary hours. If you complete a course and your discount doesn’t appear on your next bill, contact your insurer within two weeks of submission to confirm processing, since some carriers require a full billing cycle before applying the reduction.

Once you’ve identified which course type qualifies for the best discount with your specific insurer, the next step involves actually enrolling and navigating the submission process to claim your savings.

Enrolling in a Course and Getting Your Discount Applied

Contact Your Insurer First

Call GEICO at 1-800-861-8380, reach out to your State Farm agent, or check your insurer’s website for their specific list of approved providers. This single step prevents wasting money on a course they won’t accept. Your insurer will tell you the exact discount percentage available in your state, minimum course hours required, and whether online options qualify.

Some carriers like Allstate demand a minimum six-hour program, while others accept four-hour courses. Once you know these requirements, compare course options against your schedule and budget.

Select and Enroll in an Approved Course

The National Safety Council and American Safety Council offer nationwide online courses starting at $25 to $55, with completion times ranging from four to eight hours. If you’re an AARP member, you’ll save 10% on the Smart Driver course before your insurance discount even applies, creating immediate value. Online courses let you complete the material at your own pace, typically finishing within two to three days of starting.

In-person options cost more (around $50 to $100) but some drivers prefer the structured environment and immediate interaction with instructors. Enroll directly through the provider’s website or phone line after selecting your course. You’ll need your driver’s license number, state of residence, and insurance policy details during registration. Most providers process your enrollment instantly and grant immediate access to course materials.

Complete Your Course and Obtain Your Certificate

Finish your driver safety course within the timeframe specified by your insurer, then download or request your certificate of completion immediately after finishing. This certificate serves as your proof of completion and must be submitted to your insurer to activate the discount. Contact your insurance company within two weeks of completing the course-don’t wait until your next renewal.

You can submit your certificate through your insurer’s online portal, email it to the address listed on their approval documentation, or mail a physical copy to your local agent. Include your policy number, driver’s license number, and course completion date with your submission.

Track Your Discount Application

Some insurers like GEICO process certificates automatically after receiving completion data from approved providers, meaning the discount appears without manual submission. Check your next billing statement to confirm the discount applied correctly; if it hasn’t appeared within a full billing cycle, contact your insurer immediately.

Request written confirmation that the discount is active on your policy so you have documentation for future reference. If you encounter delays, escalate the issue to a supervisor rather than accepting vague timelines. Your discount should reflect on your next premium or renewal date, depending on your base premium and the discount percentage your state allows.

Final Thoughts

A driver safety course for insurance discount purposes delivers immediate financial returns that most drivers underestimate. Your savings compound quickly-a $50 annual discount from a $25 course pays for itself within six months, and three-year discounts typically save between $150 and $600 depending on your base premium and state regulations. Beyond the premium reductions, the National Safety Council reports a 17.6% reduction in state-recorded accidents in the year following course completion, meaning you become statistically safer behind the wheel.

Contact your insurance company this week to confirm which approved courses qualify for discounts in your state and the exact percentage you’ll receive. Online options from Driver Educators take four to eight hours and cost $25 to $55, making them accessible regardless of your circumstances. Then enroll in a course that matches your insurer’s requirements and your schedule.

If you’re in Florida or seeking a comprehensive program with personalized instruction, DriverEducators.com offers Florida-approved traffic school courses including Basic Driver Improvement, Intermediate Driver Improvement, and Mature Driver courses designed specifically to help drivers qualify for insurance discounts. Their self-paced online format lets you complete requirements on your timeline while building genuine driving confidence. Start your course enrollment today and claim the discount you’ve earned.