Feeling the sting of high car insurance premiums? The fastest way to get some relief is by shopping around, bundling your policies, and raising your deductible. These three moves alone can often lead to immediate and significant savings on your very next bill.

Quick Wins for Lower Car Insurance Premiums Today

If your car insurance bill is starting to feel like another car payment, you're not wrong. Premiums are climbing everywhere, but that doesn’t mean you have to accept it. You can take control with a few powerful, straightforward tactics that offer immediate financial relief without a major life overhaul.

Think of these as the low-hanging fruit of insurance savings—actions you can take this afternoon to see a real difference. The goal is simple: stop overpaying for the coverage you need. This means actively managing your policy instead of just letting it auto-renew every year. Let's get into the most effective strategies you can put into play right away.

Start with Comparison Shopping

The single most powerful move you can make is to shop around. I can't stress this enough. Every insurer uses its own secret sauce to calculate risk, which means the price for the exact same driver and car can be drastically different from one company to the next. Loyalty rarely pays in the insurance game; in fact, it can easily cost you hundreds.

Recent industry reports show this isn't just a small difference. Switching providers saved drivers an average of 12-20%, which works out to about $250-$400 in annual savings on a standard full-coverage policy.

Adjust Your Deductible

Your deductible is simply the amount of money you agree to pay out-of-pocket on a claim before your insurance coverage starts paying. It's a classic trade-off:

- A higher deductible means you're taking on a bit more of the initial risk.

- In return, you get a lower premium. Your insurer rewards you for sharing that risk.

Just by raising your deductible from $500 to $1,000, you could slash the cost of your collision and comprehensive coverage by 15% to 30%. It’s a fantastic way to save, but be honest with yourself—make sure you have enough in an emergency fund to comfortably cover that higher amount if you ever need to file a claim.

Bundle Your Insurance Policies

Do you have renters or homeowners insurance with one company and your auto policy with another? Combining them, a practice known as bundling, is one of the easiest ways to score a multi-policy discount.

Insurers love it when you bring all your business to them, and they offer big incentives to do so. This discount typically ranges from 5% to 25% off both policies, making it a simple yet highly effective way to cut your total insurance costs. Plus, it just makes life easier with fewer bills to manage.

Another great way to stack up the discounts is by taking a defensive driving course. You can learn more about how that works in our guide on defensive driving class benefits for insurance.

Here’s a quick-glance table summarizing these high-impact strategies.

Immediate Actions for Lower Car Insurance Premiums

This table breaks down the most effective strategies you can use right now, giving you a clear picture of what to expect in terms of savings and the effort involved.

| Action | Potential Savings | Effort Level |

|---|---|---|

| Comparison Shop | 12% – 20% annually | Medium (takes an hour or two) |

| Increase Deductible | 15% – 30% on certain coverages | Low (a single phone call) |

| Bundle Policies | 5% – 25% on total premiums | Low (a single phone call) |

| Take a BDI Course | 5% – 15% (varies) | Medium (a few hours online) |

As you can see, a little bit of effort can go a long way. Spending just an afternoon on these tasks could easily save you hundreds of dollars over the next year.

Fine-Tuning Your Policy for Maximum Savings

Think of your car insurance policy not as some rigid document you file away, but as a living agreement that should change as your life does. So many drivers I've spoken with are paying for coverage they simply don't need, and they don't even realize it. Digging into the details of your policy is one of the most direct ways to start cutting down your premium.

It all starts with understanding the two main types of physical damage coverage: comprehensive and collision. Collision is what pays to fix your car after an accident. Comprehensive covers just about everything else—theft, a tree branch falling on your roof, vandalism, you name it. They're non-negotiable for a newer or financed vehicle, but for an older car? That's where you can find some serious savings.

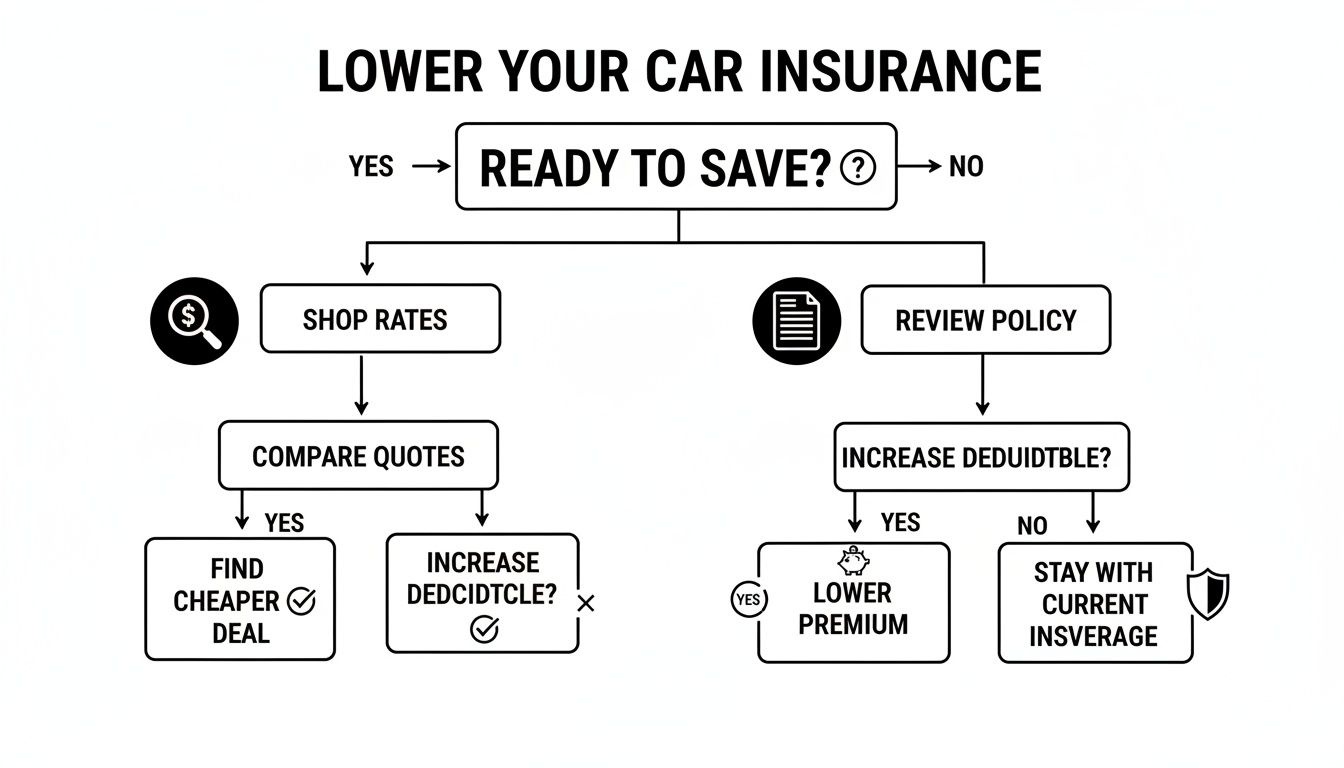

The flowchart below is a great starting point. It'll help you quickly figure out if you should be shopping for a whole new policy or just tweaking the one you already have.

This simple visual can point you in the right direction, helping you decide whether to compare new quotes or start by dissecting your current coverage for cost-cutting opportunities.

Re-Evaluating Your Coverage Needs

Here’s the big question you need to ask yourself: does my older, paid-off car still need full coverage?

A solid rule of thumb I always recommend is the "10% rule." Take a look at what you pay annually for collision and comprehensive coverage. If that number is more than 10% of your car's current cash value, it’s probably time to drop them.

For instance, let’s say your car is worth maybe $3,000, and you're paying $400 a year for comprehensive and collision. That's over 13% of its value going straight to the insurance company. In that case, you're paying for protection that just doesn't make financial sense anymore. Removing it could put a nice chunk of change back in your wallet.

Key Takeaway: Make it a yearly habit to check your car's value against your premium. As a car gets older, the need for full collision and comprehensive coverage drops, opening up a fantastic opportunity to lower your bill.

Getting a handle on how premiums are calculated is a huge advantage. You can dive deeper by checking out our guide on how much car insurance costs.

Adjusting Your Deductible for Immediate Impact

Want another tactic that delivers immediate results? Raise your deductible.

The deductible is simply the amount you agree to pay out-of-pocket on a claim before your insurance company steps in. When you choose a higher deductible, you're telling the insurer you're willing to share more of the risk. They love that, and they'll reward you with a lower premium.

And we're not talking about pocket change. The savings can be significant. Bumping your deductible from $500 to $1,000 can slash that portion of your premium by 15-30%. For a lot of drivers, that simple switch can mean saving $300-$600 a year. It's one of the smartest and easiest moves you can make.

The trick is to pick a deductible you can actually afford to pay if something happens. You absolutely must have that amount stashed away in an emergency fund. That way, it's not a gamble—it's a calculated financial decision that keeps more of your money with you.

Leverage Your Driving Habits for Better Rates

While you can’t always control the market forces that push insurance costs up, you are in the driver's seat when it comes to the single biggest factor in your premium: your driving record. How you handle yourself behind the wheel translates directly into dollars and cents on your policy. Honestly, turning safe driving into tangible savings is one of the most dependable ways to lower your car insurance bill.

A clean record is more than just avoiding tickets; it's a long-term financial asset. A single at-fault accident can stick to your policy like glue for three to five years, costing you hundreds—sometimes thousands—over that time. Insurers view a spotless history as solid proof you're a low-risk driver, and they'll reward that predictability with their best rates.

Think about it: drivers with no at-fault accidents in the past three years can see savings of up to 40% compared to those with just one incident on their record. That's a huge difference.

Proactively Proving You're a Safe Driver

Don't just wait for your clean record to speak for itself. You can take proactive steps to show your insurer you’re committed to safety. This is where a state-approved defensive driving course, like a Basic Driver Improvement (BDI) course, can be a game-changer.

Completing one of these courses sends a clear signal to your insurance company that you take responsible driving seriously. In return, many providers will offer a discount between 5% and 15%. This discount often lasts for three years, meaning the small investment of your time and a few dollars can pay for itself many times over. Just give your agent a call to see which courses are approved in Florida.

Embrace Technology with Telematics Programs

Insurers are now offering another way for you to prove you're a safe driver: telematics. You might also hear it called usage-based insurance. These programs use a small device you plug into your car or a simple smartphone app to monitor how you actually drive.

What do telematics programs track?

They’re looking at things like your mileage, how you brake (no last-minute slamming), how you accelerate (smooth and steady is best), and when you drive (avoiding risky late-night hours).

Programs like Progressive’s Snapshot or State Farm's Drive Safe & Save take this data and give you a personalized driving score. The better you score, the bigger the discount you can earn. If you’re already a cautious driver who doesn’t put a ton of miles on your car, this is a fantastic way to get a premium that truly reflects how low-risk you are.

The table below breaks down how certain events—both good and bad—can impact what you pay over time.

Impact of Driving Events on Premiums

This table illustrates how different driving incidents and positive actions can affect your car insurance premiums over a three-year period, based on industry averages.

| Driving Event | Average Premium Impact | Duration of Impact |

|---|---|---|

| At-Fault Accident | +20% to 40% | 3-5 Years |

| Speeding Ticket | +10% to 25% | 3 Years |

| BDI Course Completion | -5% to 15% | 3 Years |

| Clean Driving Record | Up to -40% | Ongoing |

| Telematics Enrollment | -5% to 30% | Ongoing |

As you can see, the consequences of a single mistake can be costly and long-lasting, while positive actions offer sustained savings.

At the end of the day, your actions on the road have a direct and lasting financial impact. For a deeper dive into this, you can learn more about how points impact your insurance in our detailed guide. By keeping a clean record, taking a defensive driving course, and maybe even trying a telematics program, you actively take control of your risk profile and unlock the significant savings that come with being a safe, responsible driver.

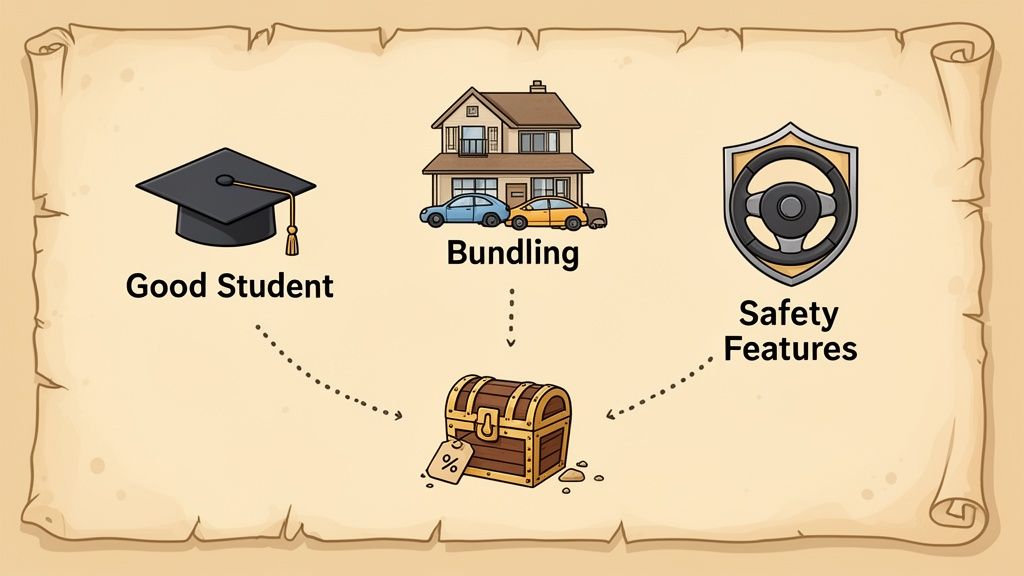

Go On a Discount Treasure Hunt

Insurance companies offer a whole menu of discounts, but here's the catch: they rarely serve them up on a silver platter. You often have to be the one to ask. Think of it as a treasure hunt where the prize is a lower monthly bill. If you're not asking, you're almost certainly leaving money on the table.

It’s easy to assume you’re getting the best deal, especially if you’ve been loyal to one company for years. But your life changes, and so do their discount offerings. A discount you weren't eligible for last year might be your ticket to significant savings today.

Let's dig into the common discount categories so you know exactly what to bring up with your agent.

Discounts Tied to You and Your Policy

Some of the biggest savings are directly related to your personal profile and how you set up your policy. These are the low-hanging fruit you should grab first.

- Good Student Discount: Got a student on your policy in high school or college pulling a "B" average or better? That can knock off up to 15%. Insurers have found a clear link between good grades and responsible driving habits.

- Defensive Driving Course: Proving you're a safe driver pays off. Completing a state-approved course shows you’re committed to safety, and many companies will reward you with a multi-year discount. You can see what it takes to find a qualifying driver safety course for an insurance discount and how the process works.

- Pay-in-Full Discount: It’s tempting to pay month-to-month, but if you can swing it, paying your entire six-month or annual premium at once can net you a nice little discount. It saves the insurer on administrative costs, and they’ll often share those savings with you.

- Multi-Car Discount: This is one of the easiest and most common ways to save. If you have more than one vehicle in your household, putting them all on the same policy almost always results in a lower rate per car.

These are the kinds of discounts that a single, well-prepared phone call to your agent can uncover. Don't be shy; it's your money.

Savings Based on Your Car and Connections

Beyond your driving habits, the car you drive and even your profession can unlock another layer of savings. These are often overlooked but can make a real difference.

Pro Tip: Don't just ask your agent, "Am I getting all my discounts?" That's too easy to dismiss with a quick "yes." Get specific. Ask, "Am I getting the discount for my anti-theft system? What about the good student discount for my daughter?" This forces them to check each one individually.

Make sure to inquire about these, too:

- Vehicle Safety Features: Modern cars are loaded with safety tech. Anti-lock brakes, multiple airbags, and factory-installed anti-theft systems can each shave a few percentage points off your premium.

- Affinity/Occupational Discounts: Insurers love to partner with large organizations. Are you a member of an alumni association, a credit union, or a professional group for teachers, engineers, or first responders? There could be a special rate waiting for you.

Being persistent here is the key. Every single discount, no matter how small it seems, chips away at your premium. By methodically going through this list, you can be confident you’re paying the lowest possible rate you truly deserve.

How Your Car and Location Quietly Drive Up Your Insurance Bill

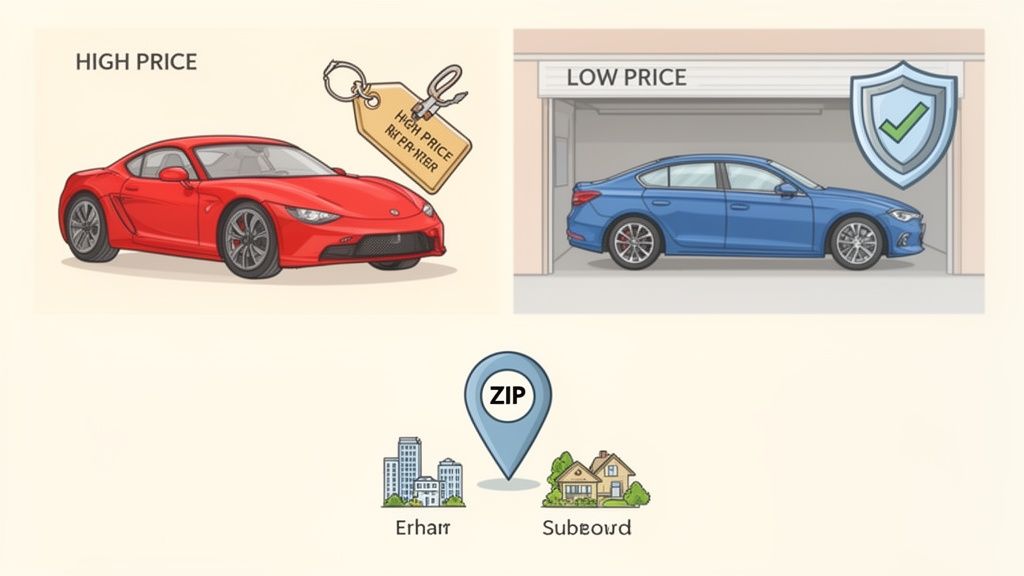

It's natural to think your driving record is the biggest factor in your insurance premium, but there are two other heavy hitters at play: the car you drive and where you park it at night. Insurance companies are in the business of risk assessment, and to them, certain cars and ZIP codes are just plain riskier than others. Getting a handle on how they see things is the first step to making smarter choices that can seriously lower your bill.

The make and model of your car have a direct and significant impact on your rates. Insurers scrutinize a vehicle's repair costs, how often it gets stolen, and its safety ratings from crash tests. This is why a practical sedan is almost always cheaper to insure than a high-performance sports car—the sports car costs a fortune to fix and, let's be honest, is more likely to be involved in a high-speed claim.

Here's a pro tip: Before you even test-drive a car, do a quick check on what it might cost to insure. A few minutes of research can save you from a nasty surprise after you've already signed on the dotted line.

Your ZIP Code Says More Than You Think

Just as critical as what you drive is where you park it. Your address tells an insurance underwriter a detailed story about the potential dangers your car faces daily, even when it’s just parked.

They dig into local data looking for red flags, such as:

- Traffic Congestion: Living in a dense urban area with bumper-to-bumper traffic? That means a higher chance of fender-benders.

- Local Crime Statistics: Neighborhoods with more vehicle thefts and vandalism will always have higher comprehensive coverage costs.

- Wild Weather: If your area is a magnet for hail, hurricanes, or flooding, that environmental risk gets factored directly into what you pay.

The Big Picture: Your rate isn't just about you. It's also about the collective risk of everyone around you. I've seen clients' premiums jump noticeably just from moving from a quiet suburb to a bustling city, even with a perfect driving record.

Using This Insider Knowledge to Your Advantage

Okay, so you're probably not going to move to another state just for cheaper insurance. But knowing these factors still gives you a powerful edge. It demystifies your premium and helps you make better long-term decisions.

For instance, when you're next in the market for a car, pull up the ratings from the Insurance Institute for Highway Safety (IIHS). Choosing a vehicle that scores high on safety and has a reputation for reasonable repair costs is a guaranteed way to start with a lower premium.

And if you are moving? Expect your rate to change. That’s also the perfect trigger to shop around for new quotes. The company that gave you the best deal in your old town might not be the most competitive in your new one. Being aware of these behind-the-scenes factors puts you in the driver's seat.

Your Car Insurance Questions, Answered

Trying to figure out how to lower your car insurance bill can leave you with more questions than answers. It's easy to get tangled up in the jargon and wonder what actually works. Let's clear up some of the most common questions drivers have so you can make moves that genuinely save you money.

How Often Should I Really Shop Around?

Think of it like an annual financial check-up. You should be shopping for new car insurance quotes at least once a year, right before your current policy is set to renew. Sticking with the same company out of loyalty is a surefire way to overpay.

But don't just wait for that renewal notice. Certain life events are a huge trigger to start comparing rates immediately.

It's time to shop if you:

- Move to a new neighborhood or city

- Buy a new car (or get rid of one)

- See a big jump in your credit score

- Finally have an old ticket or accident fall off your record (usually after 3-5 years)

The insurer that gave you the best deal two years ago might be one of the most expensive for you today. The only way to know is to look.

Is Filing a Small Claim a Bad Idea?

It often is, yes. It feels counterintuitive—you pay for insurance, so why not use it? But filing a small, at-fault claim can come back to bite you in the form of a surcharge that stays on your policy for years. That rate hike can easily cost you more than the repair bill itself.

My Personal Rule of Thumb: If the repair cost is less than your deductible, or even just a couple hundred dollars over it, seriously consider paying out-of-pocket. Do the math. A $700 claim might save you money today, but a $30/month rate increase for the next three years will cost you over $1,000.

Does My Credit Score Actually Affect My Insurance Rate?

Absolutely. In most states, insurers lean heavily on a credit-based insurance score to set your premiums. From their perspective, decades of data show a strong correlation between how someone manages their finances and how likely they are to file a claim.

A better credit score positions you as a lower-risk customer, and that almost always means a lower rate. Working on your credit—paying down balances, making on-time payments—isn't just good for your financial health; it's a powerful way to cut your insurance costs.

Can I Get a Cheaper Rate if I Drive Less?

You bet. The less you're on the road, the lower your risk of an accident. It's that simple.

If your daily commute has disappeared because you now work from home, or if you've simply cut back on your driving, you need to tell your insurance company. They won't know unless you say something. Most offer low-mileage discounts, but you often have to ask.

Even better, look into a usage-based insurance program (telematics). These programs use a simple smartphone app to track your actual mileage and driving habits, rewarding safe, low-mileage drivers with discounts based on how you really drive.

Ready to turn your safe driving into real savings? At BDISchool, our Florida-approved defensive driving courses are designed to help you dismiss points from your record and unlock valuable insurance discounts. Enroll today and take a concrete step toward a cleaner record and lower premiums.