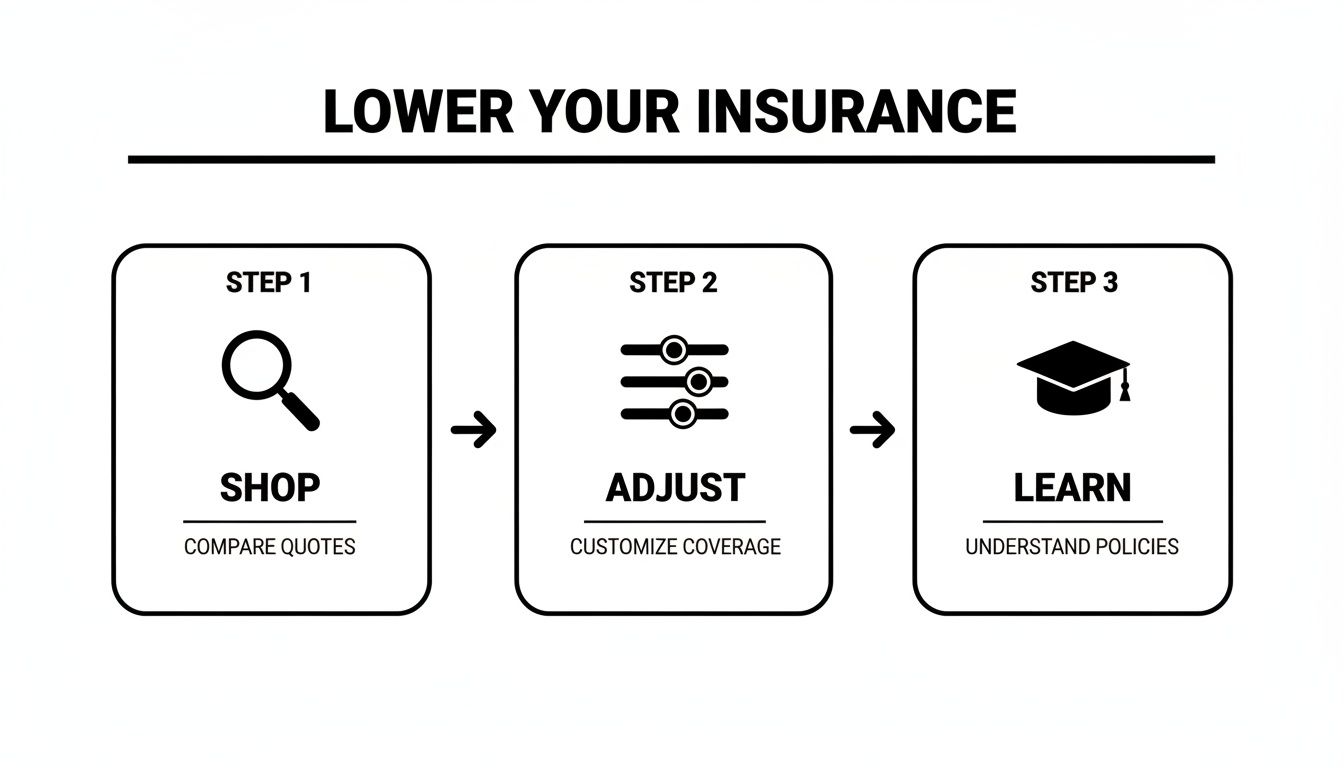

When it comes to lowering your car insurance, the secret is to be your own best advocate. You need to actively manage what insurers see as your "risk profile" while hunting down every discount you can find. A few smart moves, like comparing quotes and completing a defensive driving course, can unlock immediate and significant savings on your premiums.

Your Immediate Action Plan for Cheaper Car Insurance

Feeling the sting of high Florida car insurance costs is a common frustration, but you're not powerless. Instead of just accepting that high renewal rate, you can take control right now with a few targeted actions. Think of this as a financial first-aid kit for your auto policy—no long-term planning required, just quick wins.

The single most powerful move you can make is to shop around. I've seen it time and time again: loyalty to one insurance company rarely pays off. Rates for the exact same driver and vehicle can swing wildly from one carrier to the next. Beyond that, a simple tweak to your policy can put money back in your pocket. Raising your deductible—the amount you agree to pay out-of-pocket if you file a claim—directly lowers what you pay each month.

Immediate and Impactful Strategies

Another easy win is bundling. If you have a renters or homeowners policy, ask your agent about combining it with your auto insurance. Insurers love multi-policy customers and almost always offer a hefty discount for it. It's one of the simplest savings opportunities many drivers completely overlook.

Finally, don't underestimate the power of your driving habits. Completing a Florida-approved defensive driving course, like the one from BDISchool.com, sends a clear message to your insurer: you're a low-risk driver. The payoff is twofold: you brush up on critical safety skills and you qualify for a premium discount that can stick around for years.

This simple, proactive step demonstrates your commitment to road safety, making you a much more attractive customer. An insurer sees that and rewards it with a better rate. It’s also smart to know exactly what insurers see on your record; find out more about how to check your driving record to stay informed.

The Power of Proactive Savings

Actively shopping for quotes and stacking discounts can easily slash your bill by 20-30%. To put that in perspective, 2025 data revealed a jaw-dropping $689 annual difference between what Travelers ($1,808) and Root ($2,497) charged for similar coverage. In a state like Florida, where the average premium hovers around a painful $3,264, every dollar counts. Combining a competitive quote with a defensive driving discount can make a massive financial impact.

For a deeper dive into cost-cutting tactics that apply across different types of coverage, you can find more tips to save money on insurance premiums.

Here's a quick look at the most effective strategies you can implement today to start saving.

Quick Wins to Lower Your Car Insurance Premium

| Strategy | Potential Savings | How to Do It |

|---|---|---|

| Compare Quotes | 15-30% or more | Get quotes from at least 3-5 different insurers online or through an independent agent. |

| Raise Your Deductible | 10-25% | Increase your comprehensive/collision deductible from $250 or $500 to $1,000. |

| Bundle Policies | 5-20% | Combine your auto insurance with your home, renters, or life insurance policy. |

| Take a BDI Course | 5-10% | Complete a state-approved Basic Driver Improvement course and submit the certificate. |

These steps are all about taking immediate action. You don't have to wait for your policy to renew to start making calls and getting quotes. The sooner you act, the sooner you'll see the savings roll in.

Using Defensive Driving Courses for Deep Discounts

Looking beyond the usual policy tweaks, one of the most reliable ways to secure long-term savings is to prove you're a safe, low-risk driver. Nothing sends that message to your insurance company quite like completing a Florida-approved defensive driving course.

Think of it this way: when you take a course like the Basic Driver Improvement (BDI) program, you're not just brushing up on your skills. You're showing your insurer that you're committed to safety, which makes you a much more attractive customer in their eyes. Many people only take these courses to deal with a traffic ticket, but they're missing out on the real prize: a lasting reduction in their insurance premiums. It's an investment of a few hours that pays you back every single month.

As the infographic shows, actively learning and improving your skills is a critical part of the process for getting the best possible rates.

After you've shopped around and adjusted your policy, taking a course is the final move that can really maximize what you save.

How Defensive Driving Unlocks Savings

It all comes down to risk. Insurance companies set your rates based on how likely they think you are to file a claim. By voluntarily completing a driver safety course, you're directly lowering your risk profile. Suddenly, you're a safer bet, and insurers will often offer a nice discount to keep your business.

And we're not talking about a few dollars here. Many insurers offer discounts of up to 10-15%. In Florida, for example, taking the 4-hour BDI course after a moving violation can earn you an average discount of about 10%.

Let's put that into perspective. Imagine a Florida driver with a recent speeding ticket is paying $3,264 a year. By completing a simple online BDI course, they could save $326. That's a significant return for just a few hours of your time.

Choosing the Right Course for You

Florida has a few different types of courses, and picking the right one depends on your situation. They all aim to make you a safer driver, but they're designed for different purposes.

- Basic Driver Improvement (BDI): This is the standard 4-hour course. It's the go-to for dismissing points from a traffic ticket, but it's also the main qualifier for that sweet defensive driving discount.

- Mature Driver Course: Designed for drivers 55 and older, this program focuses on refreshing driving knowledge and addressing age-related challenges. Completing it often unlocks a dedicated "mature driver" discount that can last for years.

- Intermediate or Advanced Courses: Longer programs, like the 8-hour Intermediate Driver Improvement course, are sometimes court-ordered. However, they also signal an even stronger commitment to safety, which some insurers might reward with a bigger discount.

If you want to dive deeper, you can learn more about how a defensive driving course for insurance can specifically impact your own policy.

The most important thing to remember is that the discount isn't automatic. Your certificate of completion is your golden ticket. Once you pass the course, you have to send a copy to your insurance agent to get the savings applied to your policy.

Submitting Your Certificate for a Discount

Getting your discount is easy once you've finished the course. When you receive your certificate of completion, just follow these simple steps.

First, download and save a digital copy of your certificate right away. Don't lose it!

Next, get in touch with your insurance agent. A quick email or phone call to let them know you've completed a Florida-approved defensive driving course is all it takes.

They'll ask you to submit proof, so be ready to email them the certificate or upload it through their online portal.

Finally, follow up in a few days. Just a quick check-in to confirm the discount has been added to your policy and to find out when it will officially kick in. It's a simple step that turns a few hours of learning into real money back in your pocket.

How Your Driving Record Shapes Your Insurance Rates

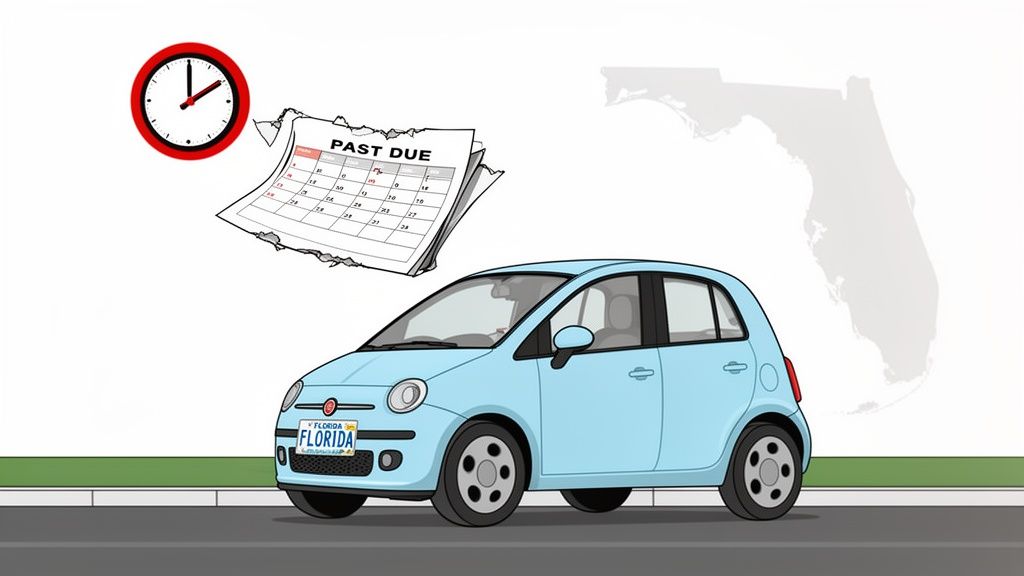

When it comes to your car insurance premium, nothing speaks louder than your driving record. It’s the single most important piece of your profile that insurers look at. Think of it as your driving resume—the cleaner it is, the more attractive you are to insurance companies, and the better rates you'll get.

Insurers are all about managing risk. A history dotted with tickets or accidents sends a clear signal that you’re more likely to cost them money in the future. Even one at-fault fender bender can make your premium jump significantly. To get a handle on just how much, you can see real-world numbers on how much your insurance might increase after an accident.

The Real Cost of a Ticket or Accident

The sting of a traffic violation isn't just the fine you pay upfront. The real pain comes later, in the form of higher insurance premiums that can follow you for years.

A single at-fault accident, for instance, can jack up your annual rate by a staggering 40-50%. That’s a tough pill to swallow, especially here in Florida where we already face some of the highest insurance costs in the country. This is why keeping your record clean isn't just about following the rules; it's a core financial strategy.

On the flip side, drivers with spotless records consistently pay 25-30% less than those with just a few minor marks. The difference is stark and shows just how much insurers value safe driving.

Smart Ways to Keep Your Record Clean

Staying out of trouble on the road isn’t about luck. It’s about being deliberate and defensive every time you get behind the wheel.

Here are a few habits I've seen make the biggest difference for drivers:

- Practice Defensive Driving: This means always thinking a few steps ahead. Watch what other drivers are doing, anticipate their next move, and always leave a safe cushion of space around your vehicle. It’s the single best way to avoid common accidents.

- Ditch the Distractions: We all know this, but it’s easy to forget. Put the phone on silent and out of reach. Program your navigation before you pull out of the driveway. Save the snack for when you’ve parked.

- Stay Sharp: Road rules can change, and our skills can get a little rusty. Taking a voluntary refresher course every few years is a great way to stay on top of your game and reinforce good habits.

I always tell people that a clean driving record is like a long-term investment. Every year you drive safely adds to its value, proving to insurers you're a low-risk driver they're eager to reward with their best prices.

Even if you’ve had a few bumps in the road (literally), all is not lost. Taking a Florida Basic Driver Improvement (BDI) course can do more than just satisfy a court requirement. It can also help you avoid points on your license, which is crucial for keeping your rates down. If you want to dive deeper, you can learn more about how traffic ticket points on insurance can impact your bottom line and what to do about them.

Making Smart Policy and Vehicle Choices to Cut Costs

Long before you even think about discounts, your car insurance premium is shaped by two huge factors: the car you drive and the policy you build around it. These are the foundational decisions. Get them right, and you're setting yourself up for serious long-term savings.

It’s easy to just renew the same policy year after year. But the coverage that made sense for your brand-new car fresh off the lot is probably overkill for that same car a decade later. Taking a hard look at your policy's nuts and bolts is the first step toward cutting out the fat and keeping what you actually need.

Fine-Tuning Your Coverage Levels

An insurance policy isn't a one-size-fits-all product. It's a bundle of different coverages, and understanding what each one does is key to not overpaying. You're looking for that sweet spot between solid protection and a reasonable price.

Let's break down the main components:

Liability Coverage: This is the one part of your policy you can't touch—it's required by Florida law. It pays for damage you cause to other people and their property. A word of caution: don't just stick with the state minimum. In a serious accident, those minimums can be exhausted quickly, leaving your personal assets vulnerable.

Collision Coverage: This pays to fix your car if you’re in an accident, no matter who was at fault. If you have a car loan or lease, you’re required to have this.

Comprehensive Coverage: Think of this as the "life happens" coverage. It handles damage from things other than a collision—like theft, a tree falling on your car, vandalism, or hitting a deer.

The real opportunity for savings comes when your car gets older. If you have a paid-off car with a low market value, say less than $4,000, paying for collision and comprehensive might not make financial sense anymore. If your deductible is $1,000, you could be paying hundreds in premiums each year for a maximum potential payout that just isn't worth it.

Here's a good rule of thumb: If the annual cost for collision and comprehensive is more than 10% of your car's Kelley Blue Book value, it’s probably time to consider dropping it.

The Vehicle You Drive Matters—A Lot

The make and model of your car have a massive impact on what you pay for insurance. Insurers aren't just guessing; they're using mountains of data on repair costs, theft rates, and safety performance for every vehicle out there.

A minivan with top-tier safety ratings and features like automatic emergency braking is going to be far cheaper to insure than a two-door sports car with a powerful engine. Similarly, a car that’s a frequent target for thieves will always come with a higher premium.

When you're shopping for a new or used car, do yourself a favor and get a few insurance quotes for the models you're considering. That "great deal" on a luxury SUV might not seem so great once you see the insurance bill. For a deeper dive into this, check out our complete guide on finding the cheapest car insurance in Florida.

Policy Adjustments vs. Potential Savings

Making a few strategic tweaks to your policy can have an immediate and noticeable impact on your premium. Here’s a quick look at some common adjustments and what they could mean for your wallet.

| Policy Adjustment | Typical Premium Reduction | Key Consideration |

|---|---|---|

| Raise Deductible to $1,000 | 10-25% | You must have enough cash saved to comfortably pay this amount if you file a claim. |

| Drop Collision/Comprehensive | 20-40% | This only makes sense for older, low-value cars you could afford to replace yourself. |

| Choose an Insurance-Friendly Car | 5-15% | Research vehicles with excellent safety ratings and low repair costs before you buy. |

By thinking strategically about the car you drive and the coverage you carry, you're not just hunting for discounts—you're building a smarter, more affordable insurance plan from the ground up.

Uncovering Every Available Insurance Discount

Your insurance company has a whole menu of discounts, but they’re not always proactive about offering them. Don't think of your policy's price as set in stone; it's more of a starting point. It’s up to you to dig in and claim every dollar of savings you deserve.

Most people know about bundling policies or getting a break for being a safe driver, but the real money is often hiding in discounts that aren't so obvious. Your mission is to become an expert on what your insurer offers so you’re not leaving cash on the table.

Beyond the Obvious Discounts

Let’s get into the discounts that often fly under the radar. Many of these are tied to your lifestyle, what you do for a living, or even the tech built into your car. On their own they might seem small, but together they can seriously slash your annual premium.

Low-Mileage Discount: Working from home now? Is your commute just a few miles? If you drive less than the average—usually under 7,500 to 10,000 miles a year—you should absolutely be getting a discount. From an insurer's perspective, less time on the road means less risk.

Occupation-Based Savings: Insurers have found that people in certain professions tend to be safer drivers. Teachers, engineers, scientists, first responders, and military members often get a nice little rate reduction. Never assume your job isn't on the list—it costs nothing to ask.

Good Student Discount: This is a big one. If you have a high school or full-time college student on your policy who maintains a "B" average (3.0 GPA) or better, you could knock as much as 15% off your premium. You’ll just need to send in a copy of their report card or transcript to prove it.

Vehicle Safety Features: Cars today are loaded with safety features, and insurance companies love them. You can get small discounts for things like anti-lock brakes and daytime running lights, but the bigger savings come from anti-theft systems like a car alarm or a GPS tracking device.

The key is to be your own advocate. Set aside time to call your agent for a dedicated "discount review." Treat it like an audit. Go down a checklist and have them verify every single discount you think you might qualify for. I’ve seen that one phone call save people hundreds of dollars a year.

Your Discount Audit Checklist

When you get on the phone with your agent, don't just ask, "Am I getting all my discounts?" Be specific. Use this as a guide to jog their memory and make sure nothing is overlooked.

Driver Profile Discounts:

- Good Student (for drivers under 25)

- Defensive Driving Course Completion (like a BDI school certificate)

- Mature Driver (usually for those over 55)

- Away-at-School Student (for a student who goes to college over 100 miles away and doesn't take a car)

Policy and Payment Discounts:

- Multi-Policy (bundling your auto with home or renters insurance)

- Paid-in-Full (paying your 6- or 12-month premium at once)

- Auto-Pay / Paperless Billing

- Loyalty (for being a long-time customer)

Vehicle-Specific Discounts:

- Anti-Theft System (alarms, tracking devices)

- Passive Restraint (factory-installed airbags and motorized seatbelts)

- New Car Discount (often for cars less than three years old)

Taking the time to audit your policy for these hidden gems is one of the smartest and easiest ways to lower your car insurance bill. You're not changing your coverage one bit—you're just making sure you’re paying the absolute lowest price for it.

A Few Common Questions About Lowering Car Insurance

When you start digging into ways to lower your car insurance, you're bound to have questions. It can feel like a bit of a maze, especially when you're trying to figure out timelines and what really matters to your insurer.

Let's clear up some of the most common questions Florida drivers ask. I'll give you the straight answers you need to start taking control of your premiums.

How Quickly Do Discounts Actually Show Up?

This is the big one, and the answer really depends on what change you're making. Some savings are practically instant, while others need a little more patience.

- Policy Adjustments: If you decide to raise your deductible or tweak your coverage limits, that change to your premium usually happens right away. You should see the new, lower price on your very next bill.

- Defensive Driving Courses: Once you send in your BDI course completion certificate, most insurance companies will add the discount within one or two billing cycles. It never hurts to make a quick follow-up call to your agent just to confirm they've got it and know when it'll kick in.

- Shopping for a New Policy: This one's easy. When you switch to a new insurance company for a better rate, your savings start the day your new policy goes into effect.

Will Just One Accident Really Jack Up My Rates?

Yes, unfortunately, it almost certainly will. This is especially true if the accident was your fault. Insurance is all about risk, and a fresh accident on your record immediately flags you as a riskier driver to insure.

Just a single at-fault accident can send your premium soaring by an average of 40-45%. The final number will depend on how serious the accident was and what your driving history looked like before. Even with a spotless record, you should brace for a major increase that can follow you around for three to five years.

This is exactly why a clean driving record is your single most powerful tool for keeping insurance costs down over the long haul. It's the best proof you can offer that you're a safe bet.

Does My Credit Score Really Matter for Car Insurance?

In Florida, your credit history has a surprisingly significant impact on what you pay for car insurance. Insurers use something called a credit-based insurance score, which helps them predict how likely you are to file a claim. The data shows that people with higher credit scores file fewer claims.

So, improving your credit score—by doing things like paying your bills on time and keeping credit card balances low—can directly translate into cheaper car insurance rates down the road. It’s a factor most drivers don't even think about, but it has a very real impact on your wallet.

How Often Should I Be Shopping for New Insurance Quotes?

Don't wait until you get a renewal notice that makes you angry to see what else is out there. The smartest move is to get fresh quotes on a regular schedule. It's the only way to be sure you’re not overpaying.

I always recommend shopping around at these key moments:

- Once a Year: Think of it as a financial check-up. Insurance rates are constantly changing, and the company that gave you the best deal last year might be more expensive this year.

- At Renewal Time: Your policy renewal is the perfect reminder. Before you just let it renew, take 30 minutes to see if your new rate is still competitive.

- After a Big Life Change: Major life events are huge for insurance. Getting married, buying a home, or even moving to a new zip code can all change your rates and open the door to new discounts.

Being proactive is what separates people who save from people who overpay.

At BDISchool, we make it simple to lock in those savings with our Florida-approved defensive driving courses. Our online, self-paced programs are built to help you dismiss traffic ticket points, satisfy court orders, and get that valuable insurance discount. Enroll today and take a real step toward a lower premium at https://bdischool.com.