So, what exactly is a “no-fault accident”? It might sound like no one is ever blamed for a crash, but that's not quite right.

The term simply means that your own car insurance is your first stop for covering initial medical bills and lost wages after an accident, no matter who was actually responsible for the collision.

Decoding No Fault Accidents in Florida

Let's clear up a common misunderstanding. "No-fault" doesn't mean fault disappears. It's really about how you get paid for your initial injuries, streamlining the process so you aren't stuck waiting for insurance companies to fight it out.

Think about a typical fender bender. In a traditional "at-fault" state, you'd have to wait for an investigation to prove the other driver was negligent before their insurance pays a dime. That can take weeks or even months, leaving you with a pile of medical bills. The no-fault system was designed to fix that exact problem.

The Role of Your Own Insurance

Here in Florida, the star of the no-fault system is your Personal Injury Protection (PIP) coverage. This is the part of your policy that kicks in immediately to cover your expenses, regardless of who caused the wreck.

It’s all about getting you the help you need, right when you need it.

- Immediate Payouts: You file a claim directly with your own insurance company to cover your initial medical costs and lost income. You don't have to wait on anyone else.

- Fewer Lawsuits: This approach keeps smaller injury claims out of the already crowded court system, saving everyone time and money.

- Fault Still Matters: Make no mistake, fault is still determined behind the scenes. The insurance companies will investigate to figure out who was responsible, which ultimately impacts things like your future premiums and whether you can sue for more serious injuries.

This structure is a fundamental part of the Florida state driving laws that every driver on the road agrees to follow. It’s a system built for speed and efficiency.

In fact, Florida law mandates that every driver carry a minimum of $10,000 in PIP. This coverage is set up to pay for 80% of your medical bills and 60% of your lost wages, ensuring you get compensated quickly. It’s a practical solution for a serious problem, especially when you consider the global impact of traffic accidents noted by the World Health Organization.

How Florida's PIP Insurance Really Works

The engine that makes Florida’s no-fault system run is Personal Injury Protection, or PIP. Think of it as your own personal first-aid kit for your finances after a crash. It’s not just a good idea—it’s the law. Every driver in Florida has to carry at least $10,000 in PIP coverage.

But that doesn’t mean you get a $10,000 check after an accident. This coverage is specifically designed to handle your immediate economic needs, so you aren't left waiting for insurance companies to argue about who was at fault. It's a crucial first step in understanding who pays medical bills after a car accident.

Breaking Down Your PIP Benefits

So, what does that $10,000 actually cover? Your PIP benefits are split to take care of your most urgent needs: your health and your paycheck.

- Medical Expenses: PIP pays for 80% of your necessary and reasonable medical costs. This includes everything from the ambulance ride and ER visit to follow-up doctor's appointments and physical therapy.

- Lost Wages: If you can't work because of your injuries, PIP will cover 60% of your lost income, helping you keep up with bills while you recover.

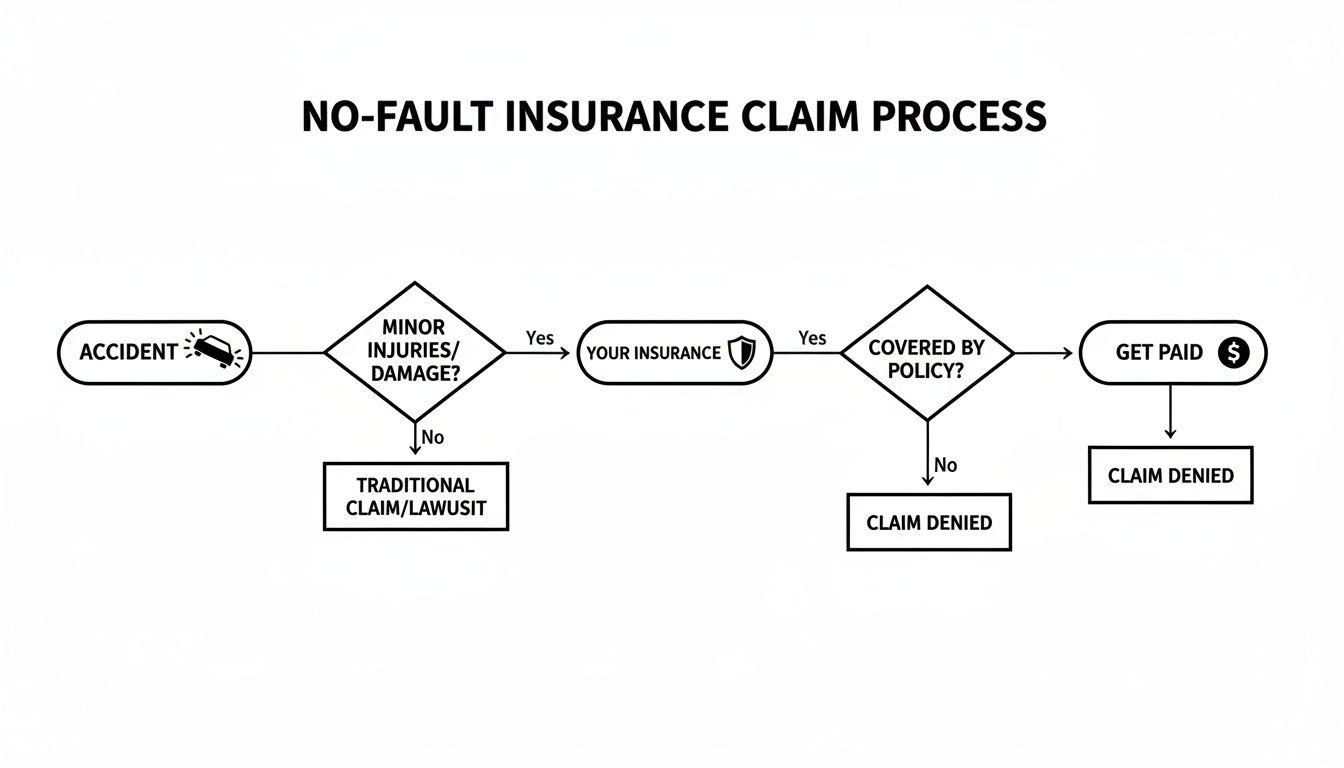

This setup ensures you get help right away, directly from your own insurance company. You report the accident to them, and they start processing your claim, as the flowchart below illustrates.

As you can see, the process is designed to be straightforward, getting you the benefits you need without having to prove the other driver was to blame first.

When Can You Step Outside the No-Fault System?

One of the biggest misconceptions about Florida’s no-fault law is that you can never sue the person who caused the accident. That’s simply not true.

Florida has what’s called a "serious injury threshold." If your injuries are severe enough to cross this line, you can step outside the no-fault system and file a lawsuit against the at-fault driver. This is typically done to recover damages for things your PIP doesn't cover, like pain and suffering.

To meet the threshold, you must have a permanent injury, significant and permanent scarring or disfigurement, or, in the worst-case scenario, the accident results in a death.

If your situation meets this legal standard, the door opens to seek compensation beyond what your own PIP policy provides. This dual approach—immediate benefits for most, and legal action for the most severe cases—is why no-fault laws were created back in the 1960s. Today, 12 states still use a version of this system.

Getting a handle on your PIP is the first step, but it also pays to understand the bigger picture of how much does car insurance cost and how to find the right coverage for your needs.

Your Action Plan After a No-Fault Accident

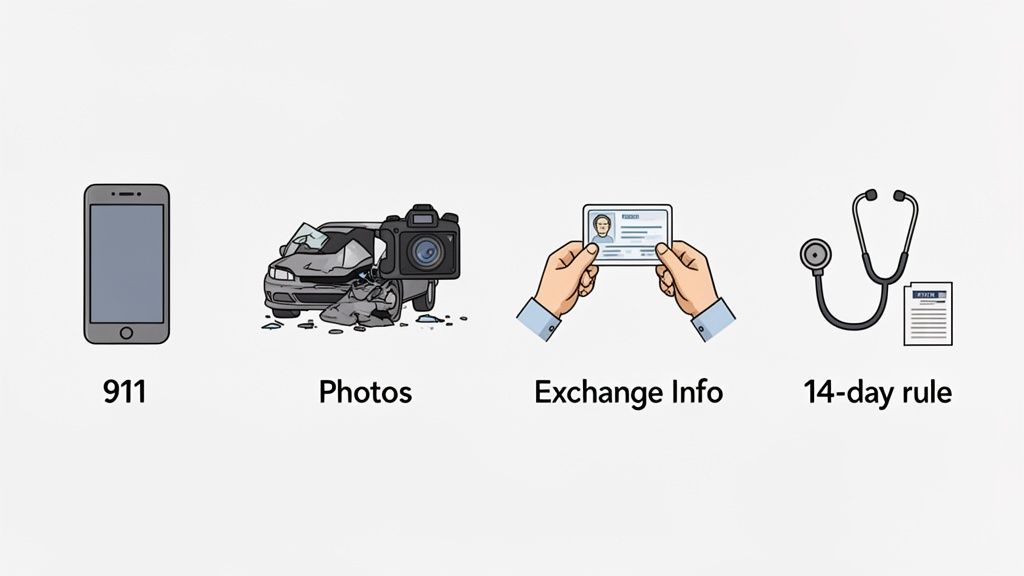

A car crash can leave you feeling shaken and confused. But even in a no-fault state like Florida, the steps you take right after an accident are absolutely crucial for protecting yourself, both physically and financially. Your first priority is always safety.

If you can, move your car to the side of the road and switch on your hazards. Check on yourself, your passengers, and the people in the other vehicle. Then, call 911 right away to get police and medical help on the scene.

Key Steps for Documentation and Reporting

What you do next builds the foundation for your insurance claim. The moments after a collision can be a blur, so having a mental checklist is a huge help. For a more exhaustive breakdown, our guide on what to do after a car accident covers everything you need to know.

Here's a quick rundown of the essentials:

- Gather Information: Swap key details with the other driver—names, phone numbers, driver's license numbers, and insurance info. Stick to the facts and never admit fault.

- Take Photos: Use your phone to become a detective. Snap pictures of the damage to both cars from every angle. Also, capture the wider scene: traffic lights, road conditions, and any skid marks.

- Get a Police Report: The official police report is an unbiased record of the accident. It's one of the most important documents you'll need for your insurance claim.

Once the scene is secure and you've collected the necessary info, it's time to call your own insurance company. But in Florida, the clock is ticking on one of the most important deadlines.

You have only 14 days from the date of the accident in Florida to get initial medical care. If you miss this deadline, you could lose your eligibility for your PIP benefits.

This is a big one. Even if you feel okay, get checked out by a doctor. Some injuries don't show up right away, and waiting too long can mean giving up your right to have your medical bills covered.

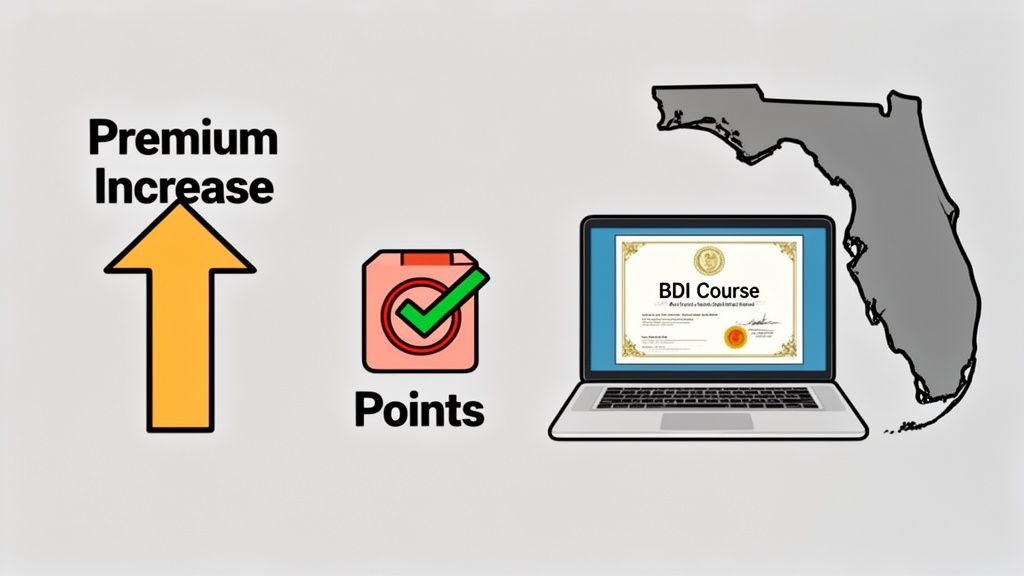

How a No-Fault Accident Affects Your Driving Record

It’s a common misconception that a "no-fault accident" means your driving record and insurance rates are completely safe. Unfortunately, that's not quite how it works. While your PIP coverage handles your immediate medical bills, the story doesn't end there.

The term "no-fault" is really about how your initial bills get paid, not a free pass on who caused the crash. Your insurance company will always conduct its own investigation to figure out who was primarily responsible. If they determine you were the at-fault driver, you can almost certainly expect your premium to go up.

Traffic Tickets and License Points

Another huge piece of the puzzle is whether a police officer issued you a traffic ticket at the scene of the accident. A citation for a moving violation—things like speeding or failing to yield—comes with points that get added to your driver's license.

These points are a red flag for your insurance provider. They signal that you're a higher-risk driver, which almost always triggers a rate hike when it's time to renew your policy.

Even a seemingly minor ticket can have a long-lasting financial sting. This is where you can take back some control. A great first step is getting familiar with the Florida drivers license points system to understand exactly what you're facing.

The good news is that Florida gives eligible drivers a powerful tool to protect their record.

- Take a BDI Course: If you complete a state-approved Basic Driver Improvement (BDI) course, you can stop the points from a qualifying traffic ticket from ever hitting your license.

- Keep Your Record Clean: When there are no points, your insurance company won't see the violation during its review. This is your best shot at avoiding that dreaded premium increase.

Taking this simple, proactive step is the smartest way to safeguard your driving record and keep your insurance costs from spiraling out of control.

Knowing When to Call a Car Accident Attorney

Florida’s no-fault system is meant to make things simpler after a crash, but that doesn’t mean you should go it alone every time. Some situations are clear signals that you need to bring in a legal professional.

A huge red flag is when your costs start to blow past your PIP coverage. If you see medical bills stacking up and getting close to that $10,000 PIP limit, it's time to act. This is the point where you might need to file a claim against the other driver to cover the shortfall.

Recognizing the Need for Legal Help

The severity of your injuries is another major factor. The no-fault system is great for bumps and bruises, but it wasn't designed for life-altering harm.

You should seriously think about calling an attorney if you're dealing with any of these issues:

- Serious or Permanent Injury: We're talking about broken bones, significant scarring or disfigurement, or any injury that permanently affects how your body works.

- Insurance Company Pushback: If your own insurance company is dragging its feet, denying your claim, or offering a ridiculously low amount, a lawyer can step in and fight for you.

- Unclear Fault: When it's not obvious who caused the accident and the other party is pointing fingers, a lawyer can protect your interests and help establish what really happened.

When a crash causes major harm, you'll need to understand the basics of personal injury law, especially if your no-fault benefits have run out or just aren't enough.

An attorney is your key to stepping outside the no-fault system once you've met Florida's "serious injury threshold." They are the ones who can sue the at-fault driver for damages PIP doesn't cover, like pain and suffering.

Think of it like this: PIP is your first aid kit for the immediate aftermath. But for severe, long-term consequences, you need a professional advocate who can fight for the full compensation you truly deserve. Don't hesitate to explore your legal options before it's too late.

Diving Deeper: Your Florida No-Fault Accident Questions Answered

Even when you understand the basics of Florida's no-fault system, the reality of an accident can bring up some tricky questions. It's designed to be straightforward, but let's be honest, insurance rarely feels simple when you're the one in the driver's seat.

So, Can I Still Get Sued in a No-Fault State?

Yes, you absolutely can, but it’s not for every fender bender. This is a common point of confusion. While your PIP insurance is your first line of defense for your own injuries, it doesn't give you a free pass from legal action.

Someone can sue you if their injuries cross what Florida law calls the “serious injury threshold.” This isn’t a vague term; it has a specific legal meaning. Generally, it includes injuries like:

- A permanent injury

- Significant and permanent scarring or disfigurement

- The permanent loss of an important bodily function

If the other driver's injuries are severe enough to meet this standard, they can step outside the no-fault system. That means they can file a personal injury lawsuit against you for things like pain and suffering, which your basic PIP coverage won't touch.

Does "No-Fault" Mean My Car Repairs Are Covered?

This is probably the biggest misconception out there. The answer is a firm no. Your no-fault PIP coverage is strictly for you—the human. It pays for your medical bills and a chunk of your lost wages if you can't work.

It does not cover damage to your vehicle. Not a single dollar.

To get your car fixed, you’ll need to turn to a different part of the insurance puzzle. The repairs will be paid for by either the at-fault driver's Property Damage Liability insurance or your own Collision coverage, assuming you have it on your policy.

Remember This: PIP is for people, not for property. Think of it as your car-crash health insurance. Your car has its own separate coverages.

What Happens if the Other Driver Doesn't Have Insurance?

Now we're getting into a scary but very real scenario. If the driver who caused the crash is uninsured or doesn't have enough insurance to cover your serious injuries, you could be left with massive bills.

This is exactly why Uninsured/Underinsured Motorist (UM/UIM) coverage exists. While it's not required in Florida, it's a financial lifeline. Your own UM/UIM policy steps in to pay for your medical expenses when the other person can't. Without it, you’re on your own.

Dealing with the aftermath of an accident is stressful enough. If you also ended up with a traffic ticket, you have options. BDISchool offers state-approved online courses designed to help you avoid points on your license and prevent your insurance rates from skyrocketing. Protect your driving record and enroll today at https://bdischool.com.