Staring at a shockingly high car insurance bill is a frustratingly common experience. If you've ever found yourself asking, "Why on earth is my car insurance so expensive?"—you're definitely not alone. The short answer is that your premium is a direct reflection of how risky an insurer thinks you are.

It’s all about a personal 'risk score' they calculate for you, which is a blend of your driving habits, where you live, the car you drive, and even bigger economic factors like inflation that affect everyone.

Deconstructing Your Car Insurance Premium

Trying to understand your car insurance rate can feel like trying to crack a secret code. But it's not random. Insurers use complex models to predict the odds that you'll file a claim. The higher they predict your risk, the higher your premium. This is precisely why two people living on the same street with similar cars can end up paying wildly different amounts.

The whole system is built on a concept called risk pooling. Think of it like a giant pot of money that all policyholders pay into. When someone in the group has an accident, the insurer uses money from that pot to cover the costs. If their data suggests you're more likely to cause a dip into that pot than the next person, you'll be asked to contribute more.

This risk assessment goes deep. It's not just about whether you've had a recent accident; it looks at a whole range of factors that have a statistical link to future claims. This diagram breaks down how they build your overall risk score from three main categories.

As you can see, your final rate isn't based on one single thing. It’s a carefully calculated mix of personal details, information about your vehicle, and data related to your location.

Key Factors in Your Risk Profile

Every insurance company has its own "secret sauce" for calculating rates, but the ingredients they use are surprisingly consistent. They're all trying to build the most accurate picture of you as a driver using data points that fall into a few key buckets.

To help you see how it all comes together, here's a quick summary of the most common factors that can send your premiums soaring.

Key Factors Driving Your Car Insurance Premiums

| Factor | Potential Premium Impact | How It Influences Your Risk Profile |

|---|---|---|

| Driving Record | High | A history of tickets or at-fault accidents signals a higher likelihood of future claims. A single at-fault accident can raise rates by 42%. |

| Age and Experience | High | Younger, less experienced drivers (especially teens) have statistically higher accident rates. Rates typically start to drop after age 25. |

| Your Location | High | Living in a busy urban area with more traffic, theft, and accidents (like many parts of Florida) automatically increases your risk profile. |

| Credit-Based Insurance Score | Medium to High | Insurers have found a strong statistical link between lower credit scores and a higher frequency of claims. |

| Vehicle Type | Medium | The car's value, repair costs, theft rate, and safety features all play a role. A sports car costs more to insure than a family minivan. |

| Coverage Choices | Medium | The more coverage you buy (and the lower your deductibles), the more you'll pay. State minimums are cheap but offer little protection. |

Each of these elements tells the insurer a small part of your story, and together they determine the final price you pay. Understanding them is the first step toward finding ways to lower your bill.

Why Florida Drivers Often Pay More

If you're a driver in the Sunshine State, you’ve probably noticed your car insurance bill stings a bit more than it does for folks in other parts of the country. It’s not just you. Florida consistently lands near the top of the list for the most expensive auto insurance, and the reasons go way beyond your personal driving record.

The high cost is woven into the very fabric of the state—its climate, its legal system, and its sheer number of people. Before an insurer even looks at your age or the car you drive, they start with a higher baseline risk just because you live here. Think of it as the "cost of doing business" in a high-risk state.

The No-Fault System and Sky-High Medical Costs

One of the biggest culprits is Florida's "no-fault" insurance system. Under this law, every driver has to carry Personal Injury Protection (PIP) coverage. The goal was simple: after an accident, your own insurance pays your initial medical bills, no matter who caused the crash. It was meant to speed things up.

Unfortunately, it's become a magnet for fraud. Shady clinics and attorneys have learned to exploit the PIP system, billing for fake or unnecessary treatments. This abuse drives up the cost of claims astronomically, and insurance companies have no choice but to pass those expenses on to you and me through higher premiums.

Florida has the second-highest rate of questionable insurance claims in the nation. This widespread fraud significantly inflates the cost of every policy, making it a primary reason why your car insurance is so high here.

In the end, honest drivers are left footing the bill for this rampant fraud.

Wild Weather and Pricey Repairs

You can't talk about Florida without talking about the weather. Our geography makes us a prime target for severe storms, especially hurricanes. Every year, thousands of cars get damaged or completely destroyed by flooding, high winds, and flying debris.

When a hurricane hits, it triggers a massive wave of claims all at once, costing insurance companies billions. To stay afloat and be able to pay out, they have to charge higher rates for everyone—especially for comprehensive coverage, which is what protects your car from weather damage. It's like a built-in "hurricane tax" on every policy.

Even on a perfect, sunny day, the environment takes a toll. The intense sun, humidity, and salt in the air can wear down a vehicle faster, leading to more frequent and expensive repairs over time.

A Lawsuit-Happy Culture and Crowded Roads

Florida has also earned a reputation for being a litigious state. This means that after an accident, people are more likely to sue, leading to long, expensive court battles and massive settlement payouts. Insurers have to bake the high probability of a lawsuit into their rates.

Finally, just look at our roads. With over 22 million residents and more than 130 million tourists visiting each year, Florida's highways are incredibly congested. More cars on the road simply means more chances for accidents. This mix of locals, tourists, and snowbirds creates a perfect storm for collisions.

The numbers don't lie. Recent reports confirm Florida is one of the most expensive states for car insurance, with full coverage policies averaging between $3,264 and $4,171 annually. This is a direct result of the state's runaway insurance fraud, constant hurricane risk, and a legal system that encourages costly lawsuits.

While you can't control the weather or change state laws, understanding why your rates are so high is the first step. For a deeper dive into actionable strategies you can use, check out our guide on how to get cheaper auto insurance.

How Your Driving Record Shapes Your Rate

Out of everything that goes into calculating your insurance premium, your driving history is the one thing you have the most direct control over. Think of it as a financial resume for your life behind the wheel, and believe me, insurers read it very carefully. Every decision you make, good or bad, gets noted and helps paint a picture of the kind of risk you are.

This is where the idea of "risk" stops being an abstract concept and starts hitting your wallet. Insurers work off a pretty simple principle: past behavior is the best predictor of future behavior. If your record is littered with tickets or accidents, they'll logically assume you're more likely to file a claim down the road. And they'll charge you for that possibility.

The Real Cost of a Single Mistake

It’s all too easy to shrug off a single traffic ticket. A minor speeding violation feels like nothing more than an inconvenient fine. But to your insurer, it’s a bright red flag. Each violation adds points to your driving record, and those points are directly tied to premium surcharges that can haunt you for years.

Let’s look at the hard numbers. A single at-fault accident can make your full coverage rates shoot up to an average of $3,774 a year. That's a massive 4.86% jump that sticks around long after the fender bender. A DUI is even more devastating, potentially blasting your annual premium to $5,106—a penalty reflecting a 6.57% higher risk. Even a simple speeding ticket can hike your premium by 40-50%, making that one moment of impatience incredibly expensive over the long haul.

These aren't just statistics; that's real money coming out of your bank account every single month, often for the next three to five years. This is precisely why understanding how points on your license affect insurance is so critical to keeping your costs down.

The connection is direct: more points on your record equals a higher perceived risk, which always translates to a more expensive insurance policy. Your driving history isn't just a record of your past; it's a key factor determining your financial future as a driver.

From Violations to Dollars and Cents

So, how does that speeding ticket actually turn into a bigger bill? When you get a moving violation in Florida, the state tacks a specific number of points onto your license. Your insurance company regularly checks these public records, and as soon as they spot new points, their system automatically flags you as a riskier driver.

Here’s a breakdown of common violations and what they can mean for your premium:

- Speeding Tickets: Even a minor ticket (15 mph over the limit or less) can trigger a serious rate increase. It signals to insurers that you have a tendency for risky behavior.

- At-Fault Accidents: This is one of the most damaging things that can happen to your premium. Being found responsible for a crash, no matter how small, tells insurers you're a direct liability.

- Serious Offenses: Things like a DUI or reckless driving are absolutely catastrophic for your rates. Premiums can easily double or triple, and some companies might drop your coverage entirely. This forces you into the much more expensive world of "high-risk" insurance.

Each of these incidents stays on your record for years, meaning you'll be paying for that one mistake long after you've dealt with the initial fine. It's a multi-year financial penalty that can ultimately cost you thousands.

A Proactive Solution to Stop Rate Hikes

The good news? You aren't completely powerless here, especially if you're a Florida driver. The state gives you a fantastic tool to protect your driving record: electing to take a Basic Driver Improvement (BDI) course.

When you get a non-criminal moving violation, you have the option to complete a state-approved BDI course. By doing this, you can stop the points from ever being added to your license in the first place. That’s the key. It doesn't remove points after they're on your record; it prevents them from ever showing up.

Taking this step is one of the most effective ways to answer the question, "why is my car insurance so high?" and actually do something about it. By keeping your record clean of new points, you give your insurance company no reason to jack up your rates over that specific violation. It's like stopping the problem at the source, protecting your good-driver status, and saving yourself from years of painful surcharges.

Personal Details That Influence Premiums

Even with a spotless driving record, you might still be staring at a high premium and asking, "Why is my car insurance so expensive?" The answer often has less to do with your driving and more to do with you.

Insurers use a huge amount of personal data to build a "risk profile" for every driver. They aren't making personal judgments. Instead, they’re playing a numbers game, using massive datasets to find statistical patterns. Based on millions of drivers, these patterns help predict who is most likely to file a claim. Let’s pull back the curtain on the personal factors that can send your rates soaring.

Age and Driving Experience

There's no sugarcoating it: age is one of the biggest factors in the insurance equation, especially for drivers at both ends of the spectrum. Younger, less experienced drivers are, statistically, involved in far more accidents. They simply haven't had the years behind the wheel to master things like spotting hazards or reacting defensively in a split second.

And this isn't just a minor surcharge; it's a massive price hike. For young drivers under 25, rates can be two or three times higher than for a middle-aged driver, with national averages hitting $2,316 per year. In Florida, it's often worse, thanks to our state's higher rates of accidents and vehicle theft. Experian's detailed analysis offers a deeper dive into these numbers.

The good news? This doesn't last forever. Rates usually start dropping once you hit 25 and continue to fall as you head into middle age, provided you keep your record clean.

Key Takeaway: You can't fast-forward your age, but young drivers aren't helpless. Staying on a parent's policy, for instance, is almost always cheaper than getting your own. Many companies also offer a "good student discount" for maintaining a high GPA, which can provide some much-needed financial relief.

Your Credit-Based Insurance Score

This one catches a lot of people by surprise. In most states, including Florida, insurers can use a credit-based insurance score to help calculate your premium. It's crucial to understand this is not your FICO score, though it is built from the information in your credit history.

So, what does your credit have to do with your driving? Insurers have found a strong statistical link between how people manage their finances and their likelihood of filing a claim. Over decades, their data shows that people with lower credit-based scores tend to file more claims. To offset that higher statistical risk, insurers charge them more.

The flip side is that improving your financial habits can directly lower your car insurance bill. You don't have to be a Wall Street wizard; simple, consistent actions work best:

- Always pay your bills on time. This has the biggest impact.

- Keep your credit card balances low. High utilization hurts your score.

- Avoid opening several new accounts in a short period.

- Check your credit report regularly for errors and dispute anything that looks wrong.

Marital Status and Homeownership

Here’s another one that seems unrelated to driving at first glance. Insurers have found that married people, on average, file fewer claims than their single counterparts. This often translates into a small but welcome discount for married drivers, as they are seen as statistically more stable and less risky.

Owning a home can also knock a few dollars off your premium. Just like marital status, homeownership is viewed as an indicator of stability and responsibility. More importantly, it opens the door to one of the easiest discounts available: bundling. When you insure your home and auto with the same company, you almost always get a significant multi-policy discount. These seemingly minor details all add up.

The Impact of Your Car and Coverage Choices

The details about you are just one side of the coin. Two of the biggest things you actually have control over are the car you drive and the level of coverage you buy. When an insurance company looks at your car, they don't just see a set of wheels; they see a long list of data points—things like repair costs, theft statistics, and safety ratings—that all feed directly into what you pay each month.

It helps to think about it this way: insuring a souped-up sports car is a bit like insuring a rare painting. Insuring a dependable family sedan is more like insuring a sturdy couch. One is a much bigger financial gamble for the insurance company to repair or replace, and that risk is reflected in your premium. So, if you're asking "why is my car insurance so high?", the answer might be sitting right in your driveway.

How Your Vehicle Drives Up Your Premium

When an underwriter assesses your vehicle, they're really just trying to predict how much a future claim might cost them. It's not personal—it's just a numbers game based on a few key factors.

Here’s what they’re looking at:

- Repair Costs: Is your car loaded with advanced sensors, expensive-to-replace parts, or a specialized body? All that tech makes repairs a lot pricier. For instance, claims for electric vehicles often cost about 25.5% more than for their gas-powered cousins because of their specialized components.

- Theft Rates: Let's be honest, some cars are simply more attractive to thieves. If your model consistently makes the "most stolen" list, your comprehensive coverage rate will be higher to account for that risk.

- Safety Ratings: This is where you can actually save some money. A car with top-tier crash test scores and modern safety features, like automatic emergency braking, is proven to be better at preventing accidents and protecting passengers. That makes it a safer bet for insurers.

When you're choosing a car, it's smart to think about the total cost of ownership, not just the sticker price. Understanding things like electric vehicle maintenance costs can give you a clearer idea of the financial profile insurers will be looking at.

The Bottom Line: Your car’s value, how complex it is to fix, and its appeal to thieves are huge factors in your insurance premium. A practical car with great safety ratings will nearly always cost less to insure than a flashy one.

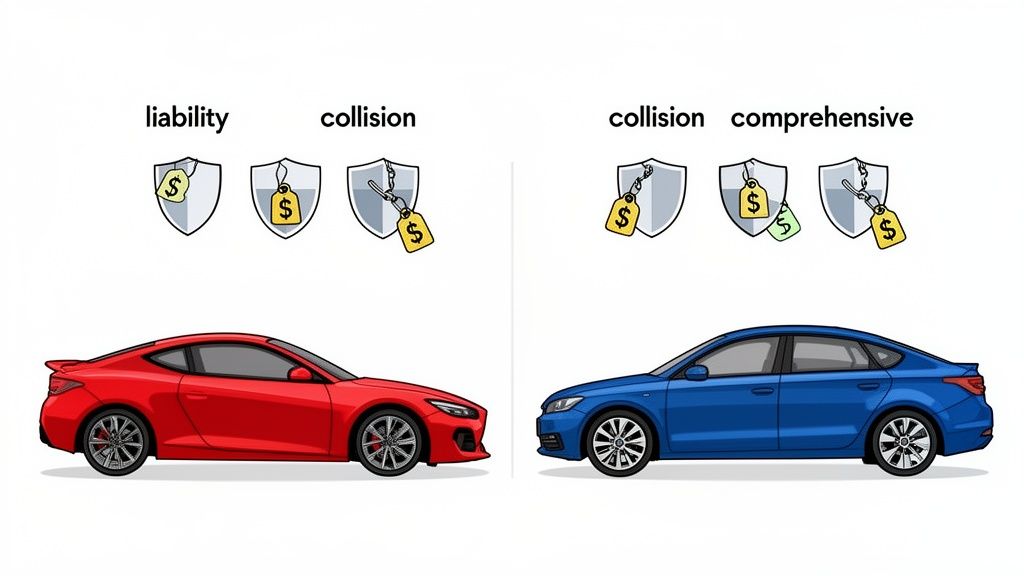

Demystifying Your Coverage Choices

The other major lever you can pull is your coverage. An insurance policy isn't a single product; it's a menu of different protections. The more you add to your plate, the higher the bill. Knowing what each one does is the key to striking the right balance between feeling protected and having an affordable premium. For a deeper dive, check out our guide on how much car insurance actually costs.

Here’s a quick rundown of the main ingredients in your policy:

- Liability Coverage: This is the bare minimum required by law in Florida. It pays for the damage you cause to other people and their property. It does nothing for your own car or your own injuries.

- Collision Coverage: This is what pays to fix or replace your car if you're at fault in an accident.

- Comprehensive Coverage: This handles damage to your car from things other than a collision—think theft, vandalism, a hailstorm, or a fallen tree. It’s pretty essential here in Florida.

Every decision you make here directly impacts your wallet. Raising your liability limits gives you better protection against a lawsuit, but it will cost you more. Your deductible—the amount you agree to pay out-of-pocket on a claim before your insurance pays a dime—is another huge factor. A low deductible feels safe, but it means a higher premium. Simply raising your deductible from $500 to $1,000 can often lead to some immediate savings.

Your Action Plan to Lower Car Insurance Costs

Knowing why your car insurance is so high is half the battle. Now it's time to take control. This isn't about passively accepting a big bill; it's about actively managing the factors you can influence to bring that premium down.

Think of this as your personal checklist for fighting back against expensive rates. By turning what you've learned into concrete actions, you can start chipping away at the key drivers of your insurance costs, one step at a time.

Start with the Easiest Wins

Some of the most powerful ways to lower your bill don't require a ton of effort. They're mostly about being a smart shopper and making sure you're getting every bit of credit you're due. Start here for the biggest impact with the least amount of work.

Shop Around Annually: This is non-negotiable. Never assume your current insurer is still giving you the best deal. Rates are always changing, and loyalty, unfortunately, doesn't always pay. Make it a habit to get quotes from at least three different companies every single year before you renew.

Ask About Every Discount: Don't wait for your agent to volunteer discounts—you have to ask for them directly. Could you get a multi-policy discount for bundling your home and auto policies? Is there a good student discount? What about a discount for belonging to a certain alumni association or professional group?

Adjust Your Deductibles: One of the fastest ways to see your premium drop is to raise your deductible. For example, simply increasing your collision or comprehensive deductible from $500 to $1,000 can create some serious savings. The key is to make sure you have that higher amount saved and accessible in case you actually need to file a claim.

Play the Long Game with Proactive Steps

While the quick wins are great, some strategies are more about playing the long game. These steps focus on improving your risk profile over time, which can lead to even bigger, more permanent savings down the road.

Protecting your driving record is paramount, but you can also make small, proactive investments that insurers love to see. For instance, making your car a harder target for thieves by installing anti-theft devices can sometimes earn you a small discount. It all adds up.

The most powerful asset you have in the fight against high insurance costs is a clean driving record. Period. Proactively protecting it isn't just a good idea; it's the absolute best way to secure long-term savings.

This is where a state-approved defensive driving course proves its worth. Here in Florida, if you get a ticket, enrolling in a Basic Driver Improvement (BDI) course lets you prevent those costly points from ever hitting your license. It's like stopping a rate hike before it even has a chance to happen.

Beyond that, many insurance companies offer a voluntary discount just for completing a course to sharpen your skills. It sends a clear message: you’re a responsible, low-risk driver. You can learn more about how this works by checking out the benefits of a driver safety course for insurance discounts. Spending a few hours on an online course can easily save you hundreds over the next few years—that’s a return on investment any driver should be happy with.

Answering Your Burning Questions About High Car Insurance

Even after laying out all the rating factors, I know you probably have some specific "what about…" questions swimming in your head. It’s a complicated world, and sometimes you just need a straight answer. Let’s tackle a few of the most common questions I hear from drivers.

Think of this as your quick-hit guide for understanding the nuances that can really move the needle on your premium.

How Long Does a Traffic Ticket Haunt My Insurance Rate in Florida?

In Florida, points from a moving violation will typically stick to your driving record for three to five years. The painful part? Your insurance company can—and usually will—use that ticket to justify a higher rate for that entire time. A single mistake can turn into a financial penalty that follows you for years.

This is exactly why dealing with points before they land on your record is so critical. Electing to take a Basic Driver Improvement (BDI) course is one of the smartest things you can do to prevent a ticket from causing a long-term rate hike.

Will a Defensive Driving Course Actually Lower My Rate?

This is a classic "yes and no" situation, and the distinction is important.

If you get a ticket, completing a Florida-approved BDI course prevents the points from being added to your license in the first place. This is huge. It stops your insurer from jacking up your rates because of that specific violation.

But what if you don't have a ticket? Many insurance companies offer a separate, voluntary discount just for taking a defensive driving course. It shows them you're a proactive, safe driver. The best move is to call your agent directly and ask what kind of discount they offer for it.

Key Insight: Taking a BDI course is a defensive move to stop a rate increase after a ticket. Taking a voluntary course is an offensive move to proactively earn a discount. Both can save you serious cash.

Should I File a Small Claim or Just Pay for It Myself?

This one requires a bit of math and foresight. Filing even a small at-fault claim can trigger a premium increase that sticks around for years. When you add up that rate hike over 3-5 years, it can easily cost you way more than the original repair bill.

My advice? Always get a repair estimate first.

If the cost is near your deductible or an amount you can handle without too much stress, paying out of pocket is almost always the smarter financial decision. You avoid the rate hike and protect your claims-free history, which often qualifies you for a nice discount all by itself.

Why Did My Rate Go Up Even Though I Have a Perfect Driving Record?

This is easily the most frustrating experience for a safe driver. You do everything right, and your bill still goes up. What gives? More often than not, it has nothing to do with you personally.

Your rates can climb because of factors completely out of your control. Maybe a major hurricane led to a statewide rate adjustment, or inflation has driven up the cost of car parts and repairs. It could even be that there's been a spike in accidents in your specific ZIP code.

This is precisely why you should shop around for new quotes every single year. Your current company might have taken a hit, but a competitor might be in a much better position to offer you a great rate for that same, spotless record.

At the end of the day, protecting your driving record is the single most powerful thing you can do to control your insurance costs. At BDISchool, our state-approved Basic Driver Improvement course is the easiest, quickest way to keep points off your license and stop a rate hike cold. Enroll in our online BDI course today and take control of your insurance premium.