Taking a defensive driving course for insurance is one of the most straightforward ways for Florida drivers to knock some money off their car insurance premiums. It’s a proactive move that insurance companies love to see, and they’ll reward you for it. Most major providers offer a nice little discount, usually between 5-15%, just for completing an approved course.

How a Defensive Driving Course Actually Lowers Your Insurance Bill

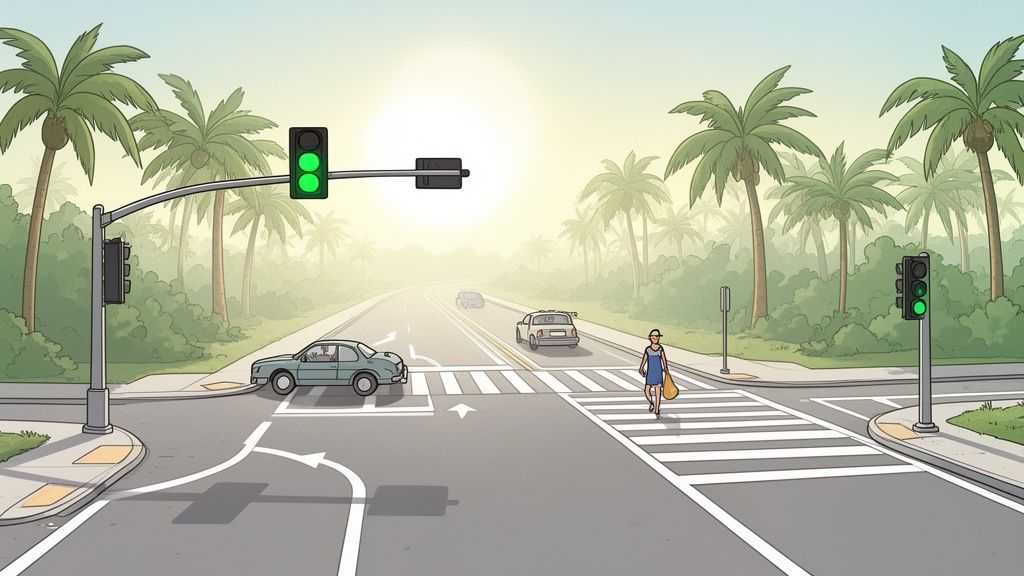

It all comes down to risk. From an insurer’s perspective, everything is about calculating the odds you’ll get into an accident and file a claim. When you voluntarily take a course to become a safer driver, you’re basically telling them, “Hey, I’m less of a risk than the average person on the road.”

They aren’t just taking your word for it, either. The data shows that drivers trained in accident-avoidance techniques are statistically less likely to get into wrecks. Fewer claims mean less money the insurance company has to pay out.

So, in exchange for you spending a few hours and a small course fee, they pass some of that savings back to you. It’s a true win-win: you sharpen your driving skills, and they reward you with a lower bill.

What This Means for Your Wallet

Let’s talk real numbers, because that’s what really matters. A typical discount from providers like GEICO, Progressive, or State Farm lands somewhere between 5% and 15%. For many Florida drivers, this can easily mean saving $100 to $300 a year. The course practically pays for itself.

Think about it this way: say you’re a driver in Tampa with a good record, paying around $1,800 a year for insurance. A modest 8% discount shaves off over $140 annually. Since that discount is usually good for three years, you’re looking at more than $420 in savings from one simple online course.

To help you see the benefits at a glance, here’s a quick breakdown of what to expect.

Florida Insurance Discount at a Glance

| Key Factor | Details for Florida Drivers | Potential Savings |

|---|---|---|

| Eligibility | Must have a valid Florida driver’s license. Typically for drivers with a clean record or those aged 55+. | 5% to 15% off your premium. |

| Course Type | Must be a FLHSMV-approved Basic Driver Improvement (BDI) course or a Mature Driver course. | Savings can total $100-$300 or more annually. |

| Discount Validity | The discount is generally valid for three years. You must retake the course to renew it. | Consistent savings over time for a small, one-time course fee. |

| How to Claim | Submit your Certificate of Completion to your insurance agent. Don’t assume it’s automatic! | Ensures the discount is applied to your policy promptly. |

This table summarizes the core components, but the real value comes from the skills you learn.

It’s More Than Just a Refresher Course

If you think these courses are just a boring recap of the driver’s handbook, think again. A modern, state-approved defensive driving course is designed around practical skills for handling today’s chaotic roads.

You’ll walk away with real-world strategies you can use immediately, including:

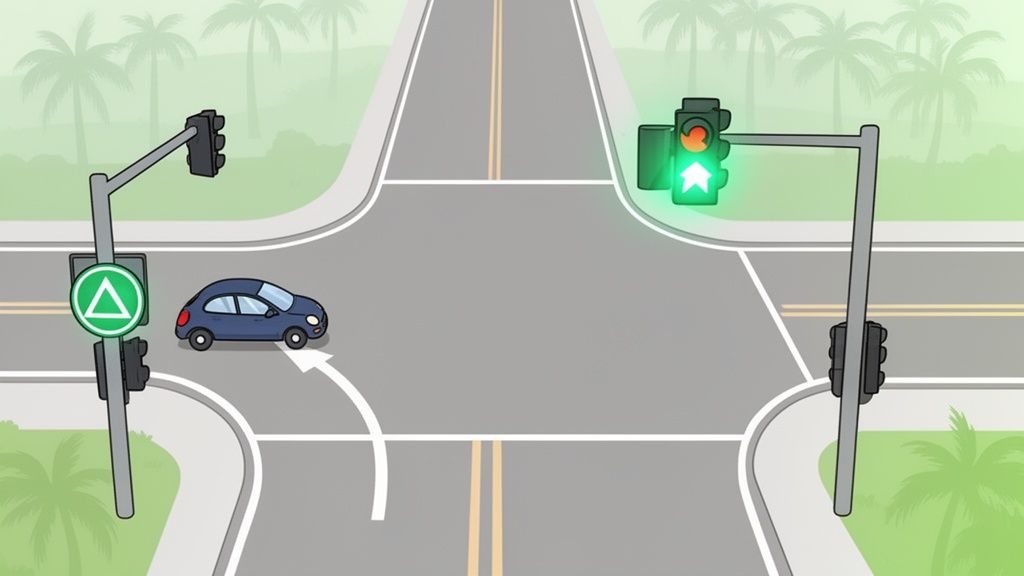

- Spotting Hazards Early: Learning to identify potential dangers—like a texting pedestrian or an aggressive driver weaving through traffic—long before they become a real problem.

- Mastering Prevention Techniques: Truly understanding and applying things like the “three-second rule” for following distance and knowing how to react in an emergency without panicking.

- Driving for the Conditions: Knowing how to adjust your driving for Florida’s sudden downpours, tourist-season traffic jams, and endless construction zones.

The core idea is to shift from being a reactive driver to a proactive one. A good course teaches you to anticipate and avoid trouble altogether, and that’s the skill your insurance company is willing to pay for.

Of course, taking this course is just one piece of the puzzle. For drivers serious about cutting costs, it pays to also look into other strategies. Combining this discount with other methods is the key to finding affordable car insurance in Florida and keeping more money in your bank account. You can also dive into our guide on other ways to how to reduce insurance premiums.

First Things First: Are You Actually Eligible for the Discount?

Before you spend a single minute or dollar on a defensive driving course for insurance, you need to get a definitive “yes” from your provider. Nothing’s more frustrating than finishing a course, excited for the savings, only to find out you were never eligible to begin with. A quick phone call upfront can save you a world of time and hassle.

Insurance companies are in the business of managing risk, and they have their own specific rules for who gets a discount. Just because your neighbor with a different insurer saved some money doesn’t automatically mean you’ll get the same deal.

Who Usually Gets the Green Light?

Insurers generally reserve these discounts for drivers they already see as low-risk. Think of it as a reward for having a good track record.

While every company’s handbook is a little different, the eligibility requirements usually boil down to a few common factors:

- A Clean Driving Record: This is a big one. Most insurers will want to see you’ve been free of at-fault accidents and serious traffic tickets for the last three to five years.

- Age Matters: In Florida, the most common discount is for mature drivers aged 55 and older. However, some companies are starting to offer similar perks for younger drivers, so it never hurts to ask.

- No Major Red Flags: A recent DUI, a reckless driving conviction, or a history of racking up speeding tickets will likely knock you out of the running. From their perspective, one course doesn’t outweigh a pattern of high-risk behavior.

It’s also a good idea to make sure your license is in good standing. If you’re not sure, you can easily find out how to check the points on your license in Florida and clear up any uncertainty.

Your Game Plan: Call Your Agent

The only way to get a straight answer is to talk to a real person. Pick up the phone and call your insurance agent or a customer service rep. Don’t just rely on what you read on a generic webpage—get the facts that apply specifically to your policy.

Think of this call as a quick fact-finding mission. Your goal is to get all the details you need to make a smart decision, with no unwelcome surprises down the road.

When you call, have a few questions jotted down. This keeps the conversation focused and ensures you don’t hang up and realize you forgot to ask something important.

Key Questions to Ask Your Insurer

- “Based on my current policy and driving history, do I qualify for a defensive driving discount?” This is the direct, yes-or-no question you need to start with.

- “What is the exact discount I can expect?” Don’t be satisfied with a vague answer. Ask if it’s 5%, 10%, or another specific amount. This helps you calculate the actual savings.

- “How long will the discount last?” In Florida, the discount is typically good for three years, but you absolutely need to confirm this with your provider.

- “Do you have a list of approved courses?” This is non-negotiable. The course you take must be one they recognize, which in Florida means it needs to be approved by the FLHSMV.

- “What’s your process for submitting the completion certificate?” Find out exactly how they want it. Do you email a PDF, upload it to their online portal, or mail in a hard copy?

Getting these answers before you sign up for a course is the single smartest thing you can do. It turns a hopeful guess into a solid financial plan.

Choosing the Right FLHSMV-Approved Course

In Florida, your path to a car insurance discount runs straight through the Florida Highway Safety and Motor Vehicles (FLHSMV). This isn’t a suggestion—it’s a requirement. You can’t just pick any random online course; it must be on the state’s official list of approved providers to count.

Getting this step right from the start protects you from wasting hours on a course your insurer will simply reject.

Think of the FLHSMV approval as a guarantee. It means the course curriculum meets Florida’s specific standards for improving driver safety. Thankfully, the state makes it easy to check.

The complete, up-to-date list of schools is available right on the FLHSMV website. I always tell people to bookmark this page because it’s the only source you should trust.

Starting your search with the official list ensures that the time and money you invest will actually result in a valid certificate that gets you that insurance discount.

What to Look for Beyond State Approval

Okay, so you have the list of approved schools. Now the real evaluation begins. Just because a course is state-approved doesn’t mean it offers a great experience. They can vary wildly in quality, flexibility, and customer support.

Here are the features I always recommend people compare to find a course that fits their life, not the other way around:

- 100% Online and Mobile-Friendly: Can you actually finish the whole course from your phone or tablet? A truly modern course should let you knock out a chapter while waiting in line for coffee or during your lunch break.

- Self-Paced Learning: Steer clear of courses with rigid page timers that lock you in place. A self-paced format puts you in control, letting you breeze through familiar topics or take your time on new material.

- Transparent Pricing: The price you see should be the price you pay. Look for schools that are upfront about the total cost, including the certificate and any state assessment fees. No one likes surprise charges.

- Real Customer Reviews: What are other Florida drivers saying? Dig into recent, independent reviews to get a feel for the course content and how helpful their support team is when you run into a problem.

The demand for these courses has created a massive global market for defensive driving training, valued at roughly $2.71 billion in 2024 and expected to nearly double by 2033. All this growth means more choices for you, but it also makes it more important than ever to pick a provider that delivers a high-quality, frustration-free experience.

A Quick Example

Let’s say a busy nurse in Orlando is looking for a defensive driving course for insurance.

School A is the cheapest on the list by five bucks, but its website looks like it was built in 2005 and is a nightmare to use on a phone. School B costs a little more but has a clean, modern app and offers 24/7 chat support.

For someone who only has small pockets of free time during a hectic day, School B is the obvious choice. That small price difference buys a smooth, convenient experience and peace of mind. I’ve found it’s always worth it to choose an approved traffic school online that invests in user experience, not just a rock-bottom price tag.

How to Actually Get Through Your Online Course

Alright, so you’ve signed up for an online defensive driving course for insurance. The key to actually finishing it and learning something is to treat it like any other commitment—not just another browser tab you have open. Let’s be honest, the goal is to get that discount, but it’s also a chance to sharpen skills that keep you safe on the road.

Trying to binge the entire course in one sitting is a classic mistake. I’ve seen people try it, and by hour three, their eyes are glazed over and they aren’t absorbing a thing. A much smarter way to tackle it is in smaller, focused chunks.

Set aside 45 to 60 minutes at a time. This gives you enough time to get through a module or two while you’re still sharp. Then, take a real break. This is exactly why the best self-paced online courses are so popular; they work around your life, not the other way around.

It’s Not Just About Passing the Final Exam

As you go through the lessons, try to connect the dots. Don’t just skim the text to get to the quiz. When the course explains why you should maintain a three-second following distance, pause and think about it. Understanding the logic makes the rule stick in your brain, which is far more useful than just memorizing a number for a test.

This is where practice quizzes come in handy. Most good courses have them at the end of each section. Don’t skip them! They’re a no-pressure way to see what you’ve actually retained and what you might need to glance over again before you move on.

Think of it this way: your insurance company is willing to give you a discount because they believe you’re becoming a lower-risk driver. The real win isn’t just passing the final exam; it’s internalizing the concepts that make you one.

When you’re engaged in a course, seeing how the information is structured can make all the difference. Understanding what makes for effective step-by-step instructions can actually help you process the material more efficiently.

A Few Tips on Note-Taking

Even though it’s all online, jotting down a few notes can be a game-changer. You don’t need a fancy notebook; a simple notes app or a text document works perfectly.

Focus on a few key things that pop out:

- Any surprising statistics about common accidents.

- Florida traffic laws you didn’t know or were fuzzy on.

- Clear, step-by-step instructions for emergency situations, like what to do if a tire blows out.

The simple act of typing it out helps lock it into your memory. Then, before you start the final exam, you can do a quick 15-minute scan of your notes. It’s a great way to walk in feeling confident and ready to go.

Getting Your Certificate to Your Insurer and Cashing In on the Discount

You did it. You finished the course and passed the final exam—nice work! Now for the best part: turning that new certificate into real, tangible savings on your car insurance. This last step is pretty simple, but it’s on you to make it happen.

Your insurance company won’t automatically know you’ve completed the course. It’s up to you to send them the proof. The good news is that most insurers have made this super easy.

Submitting Your Certificate the Right Way

Remember that initial call to your agent? You should already know how they want to receive the certificate. Getting it to them the way they prefer just speeds everything up.

Most insurance companies accept certificates in a few common ways:

- Emailing the PDF: This is usually the quickest route. Just attach the digital certificate from the driving school to an email and send it straight to your agent or the company’s main customer service inbox.

- Uploading to Their Portal: Big carriers like Progressive or Geico have online portals or mobile apps where you can upload documents directly. This is great because it creates an immediate digital paper trail.

- Snail Mail: It’s less common these days, but some old-school agents might still want a physical copy. If you have to mail it, I always recommend sending it via certified mail. It costs a few extra bucks, but that tracking number is your proof they got it.

Whatever method you choose, make sure your full name and policy number are clearly visible. If you’re emailing, put it in the subject line. If mailing, jot it down on a quick cover note. This prevents it from getting lost in a general inbox.

Ever wonder why insurers give this discount? It’s not just to be nice. The data is clear: it works. One major study looked at over 30,000 drivers and found that finishing an online defensive driving course cut their traffic violations by up to 74% in the following year. That’s a massive reduction in risk, and that’s what they’re rewarding you for. You can dive deeper into the research on driver safety training.

How Long Does It Take? Be Patient

Once you hit “send” or drop that envelope in the mail, the discount won’t magically appear on tomorrow’s bill. You need to set some realistic expectations for the timeline.

Typically, you’re looking at one to two billing cycles before you see the savings reflected on your statement. This buffer gives them time for internal processing and depends on where you are in your billing period. For instance, if you submit your certificate the day after your bill is issued, you’ll almost certainly have to wait for the next one to see the new, lower rate.

Don’t Assume—Always Confirm the Discount

This is the final, crucial piece of the puzzle: follow up. Don’t just send the certificate and assume everything is handled. A little diligence here guarantees you get the savings you worked for.

Here’s my go-to follow-up plan:

- After submitting your certificate, wait for your next two insurance bills to arrive.

- Scan each statement carefully. You’re looking for a new line item like “Defensive Driver Discount,” “Accident Prevention Discount,” or something similar.

- If it’s not there, it’s time to call your agent. Just give them a friendly ring, mention when you sent the certificate, and ask them to double-check that it was applied correctly.

That quick phone call is all it takes to get peace of mind and confirm that your effort to complete a defensive driving course for insurance has officially started saving you money.

Got Questions? Here Are Some Common Ones About Florida Defensive Driving

Even after laying out the steps, you probably still have a few questions rolling around in your head. That’s completely normal, and it’s smart to get everything sorted out before you dive in. Think of this as the “what-ifs” section, where we tackle the most common things Florida drivers ask about.

Getting these details straight from the get-go means no surprises down the road, and you can be confident you’re getting every bit of value from your time and effort. Let’s clear up a few things.

How Long Does the Insurance Discount Actually Last?

In Florida, the standard validity period for an insurance discount from a defensive driving course is three years. Most of the big insurance companies stick to this timeline.

To keep that discount going without any gaps, you’ll have to retake an approved course before your current certificate expires. Just keep in mind this is a general rule. It’s always possible a specific provider has a slightly different policy, though it’s rare.

Here’s a pro-tip from my experience: The moment you get your certificate, set a calendar reminder for two and a half years out. That gives you a huge buffer to find a course, finish it, and send in the new certificate without any last-minute panic.

Can I Use the Same Course to Dismiss a Ticket and Get the Discount?

Absolutely, and this is one of the smartest ways to get two benefits for the price of one. If you’ve been given the option to take a Basic Driver Improvement (BDI) course to handle a traffic ticket, you can usually send that same completion certificate over to your insurance company.

The trick is to be proactive. Before you even sign up for the course, call your insurance agent and ask point-blank if they’ll accept a BDI certificate from a ticket election for their discount program. The vast majority do, but verifying this little detail is crucial. It’s a simple way to maximize the return on your time and money.

What if I Fail the Final Exam?

First off, don’t sweat it. The online schools approved by the FLHSMV are genuinely designed to help you pass. Their goal is to teach, not to trick you. Pretty much every reputable school gives you another shot at the final exam if you don’t pass the first time.

Most providers will offer at least one free retake, and many give you several chances. You’ll find their specific retake policy spelled out clearly in their terms. If you do happen to fail, the best thing to do is step away for a bit, go back and review the sections that tripped you up, and then try again when you feel ready.

Do All Insurance Companies in Florida Have to Offer This Discount?

Here’s a really important one: while nearly all auto insurers in Florida offer a defensive driving discount, it is not legally required for every single company. The discount percentage, the specific rules for who qualifies, and even its availability are all decided by the individual insurance company.

This is exactly why that first phone call to your agent is the single most important step. It’s the only guaranteed way to know for sure that your provider offers the discount and that you are eligible. Never assume—just ask.

Ready to become a safer driver and start saving money? BDISchool offers FLHSMV-approved online courses that are self-paced, mobile-friendly, and designed for busy Florida drivers. Enroll in our defensive driving course today and get one step closer to lowering your insurance premiums. Learn more and sign up at https://bdischool.com.